Canada Gazette, Part I, Volume 146, Number 34: Corporations Returns Regulations

August 25, 2012

Statutory authority

Corporations Returns Act

Sponsoring agency

Statistics Canada

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the Regulations.)

1. Background

The Corporations Returns Act (the Act) was enacted in 1962 to collect financial and ownership information on corporations and unions conducting business in Canada. This information is used to evaluate the extent of non-resident control in the Canadian economy. The Corporations Returns Act and its Regulations prescribe thresholds above which corporations are obliged to report under the Act. In 1962, the Act required corporations and unions to complete an Ownership Return if, individually or in combination with their affiliates, they had assets totalling more than $250,000 or operating revenues in excess of $500,000. (see footnote 1) At that time, the number of corporations or groups of affiliated corporations to which Statistics Canada mailed the Ownership Returns was roughly 25 000.

These thresholds were last changed in 1981 for the express purpose of reducing the number of smaller corporations obliged to report under the Act. As the thresholds were expressed as absolute monetary values, inflation since 1981 has brought many corporations that were not intended to be covered within the scope of the legislation.

In addition, the Corporations Returns Act was amended in 1998 to exclude unions. However, the title and content of the Regulations were not revised to reflect this change.

2. Issues

The Corporations Returns Act (the Act) has been amended several times since 1962. However, amendments to the Corporations and Labour Unions Returns Act Regulations have not kept pace with changes to the Act.

It was always the intention of the Government that, while satisfying the need to be able to monitor the extent of foreign ownership and control of corporations in Canada, the reporting burden on corporations would be limited to the extent possible. Given that the thresholds are static in the Act and in the existing Regulations, the number of corporations required to file a return under the Act has grown while adding no value to the goal of measuring foreign control in the Canadian economy.

The existing Regulations contain an outdated version of Schedule II, the Ownership Schedule. They also contain Schedule IV, Transfer of Technology, which is no longer needed.

3. Objectives

The objectives of the proposed Regulations are

- to bring the number of corporations that are subject to the Act back in line with the original intent of the Act by raising the reporting thresholds;

- to reflect amendments made to the Act over time; and

- to update the existing Schedules II (Ownership) and III (Financial Information), which are now being renumbered as the new Schedules 1 and 2 and to eliminate Schedule IV (Transfer of Technology).

4. Description

The proposed Corporations Returns Regulations would replace the Corporations and Labour Unions Returns Act Regulations and would do the following:

- raise the reporting thresholds such that only corporations with revenues of more than $200 million, assets in excess of $600 million or foreign debt and equity over $1 million are obliged to comply;

- remove references to unions, bring the section references into line with the Act, remove references to repealed portions of the Act and replace the words “corporation” and “corporations” with the words “personne morale” and “personnes morales,” respectively, in the French version of the Regulations, in order to reflect the terminology used in the Act;

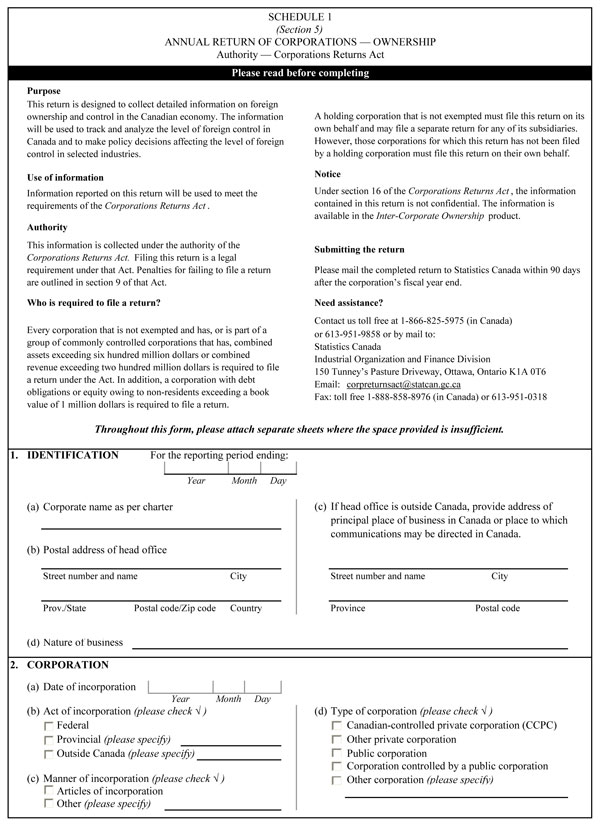

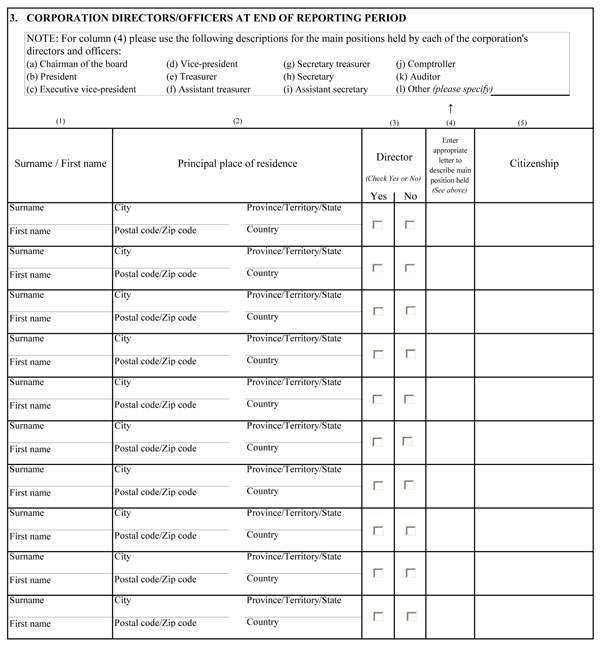

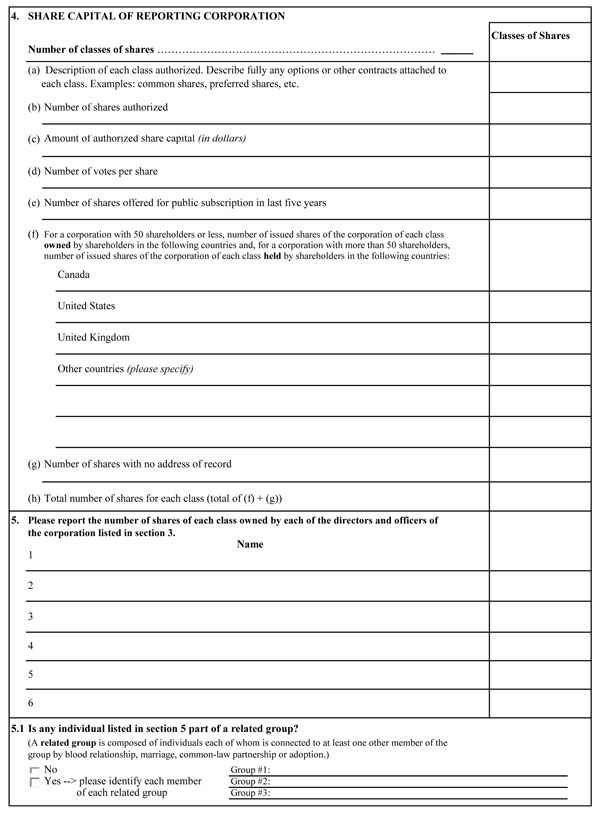

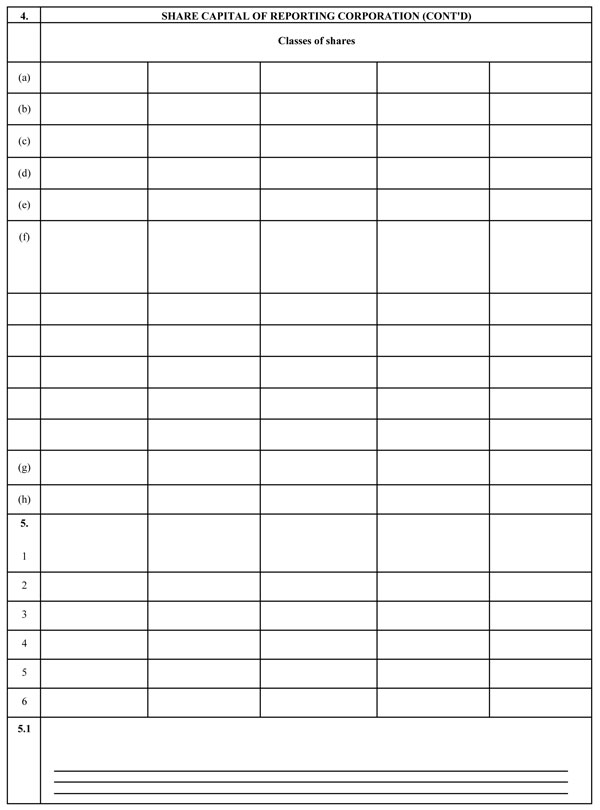

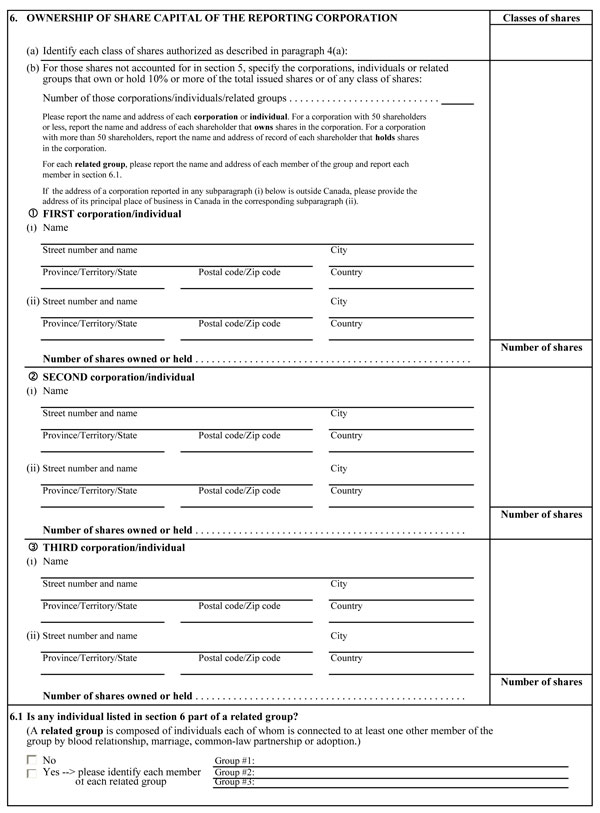

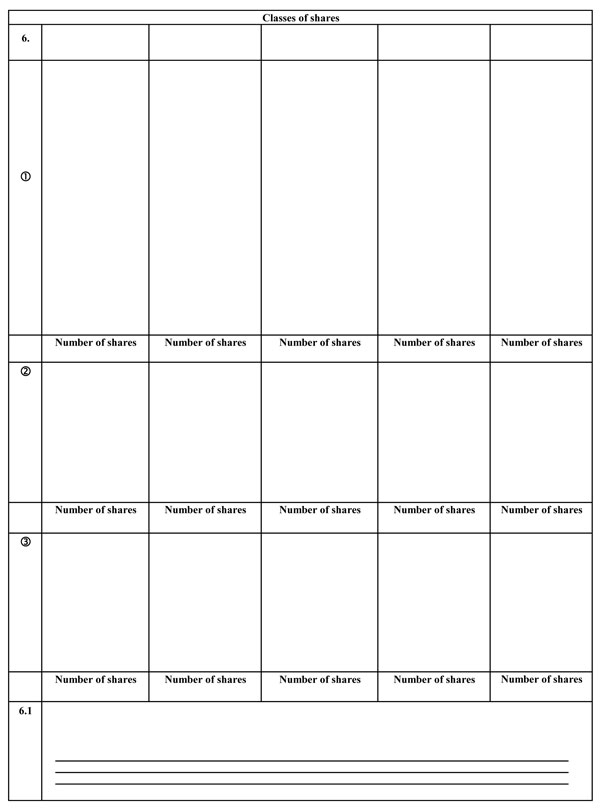

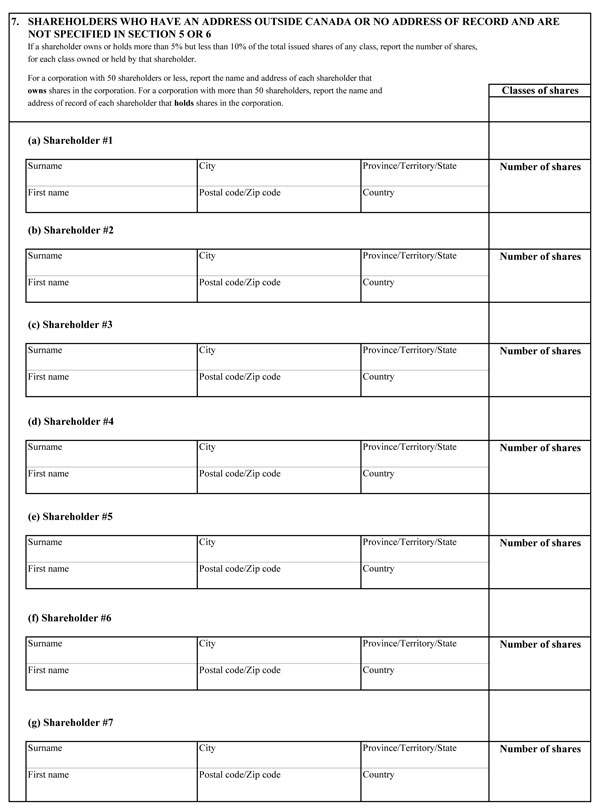

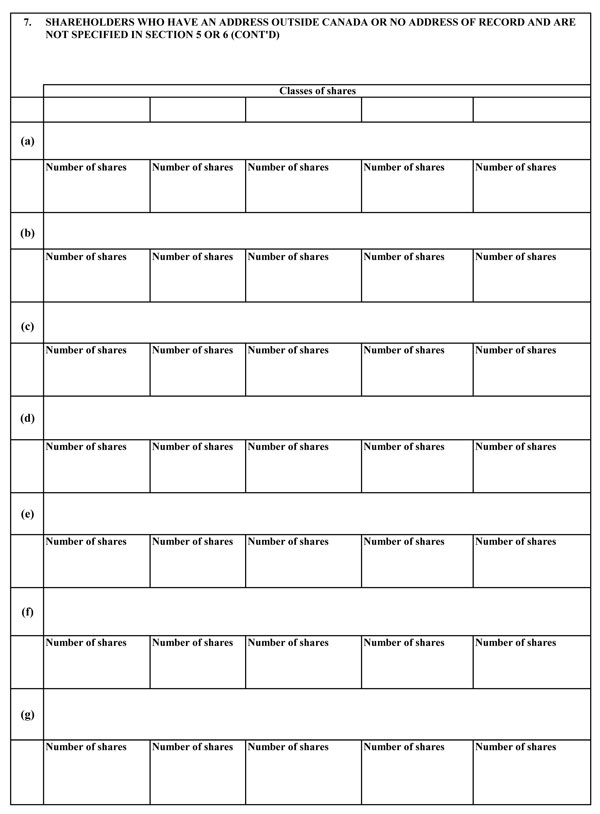

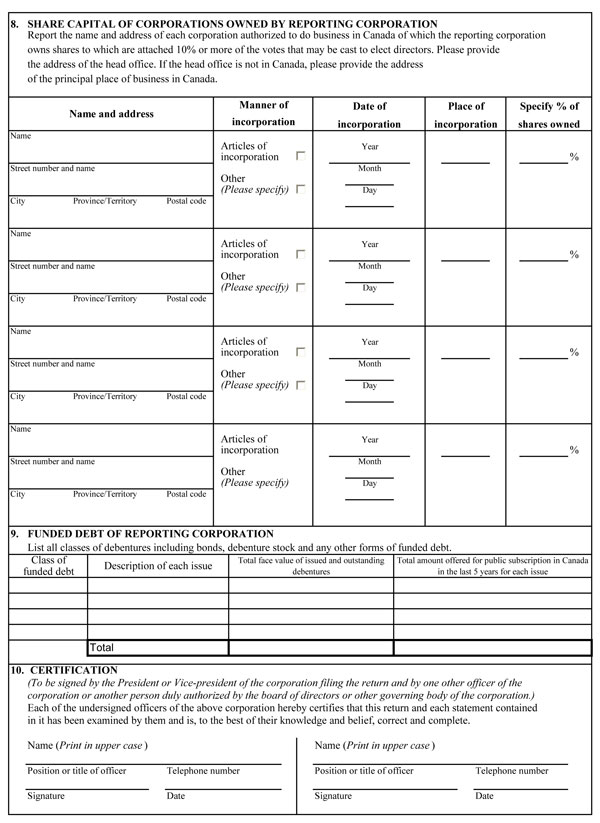

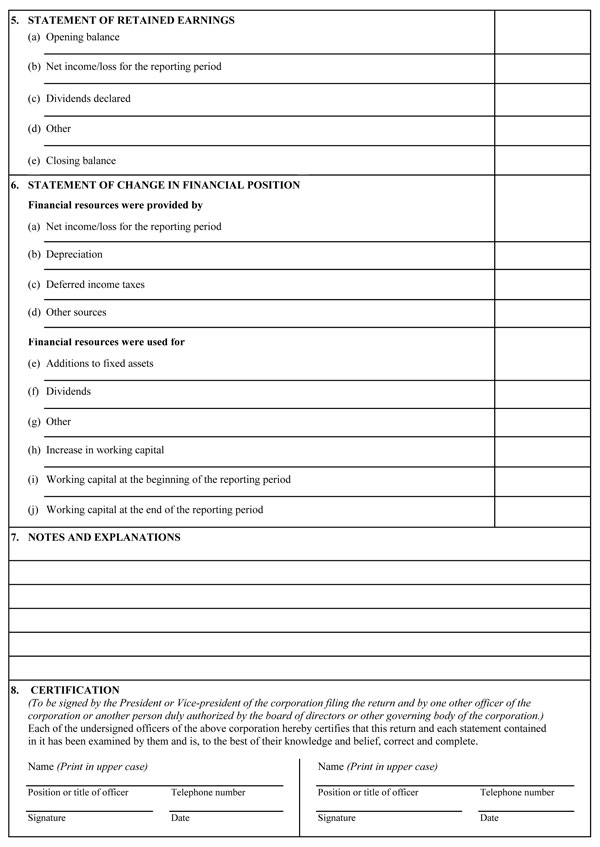

- provide an updated Ownership Schedule (the new Schedule 1) containing clearer instructions, definitions and layout to make it easier to complete and submit;

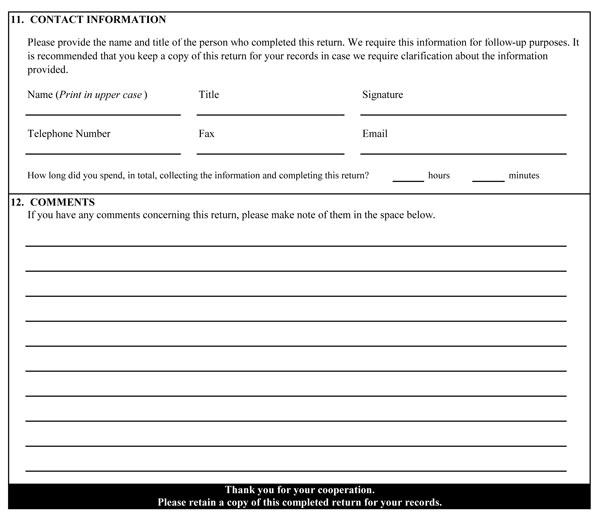

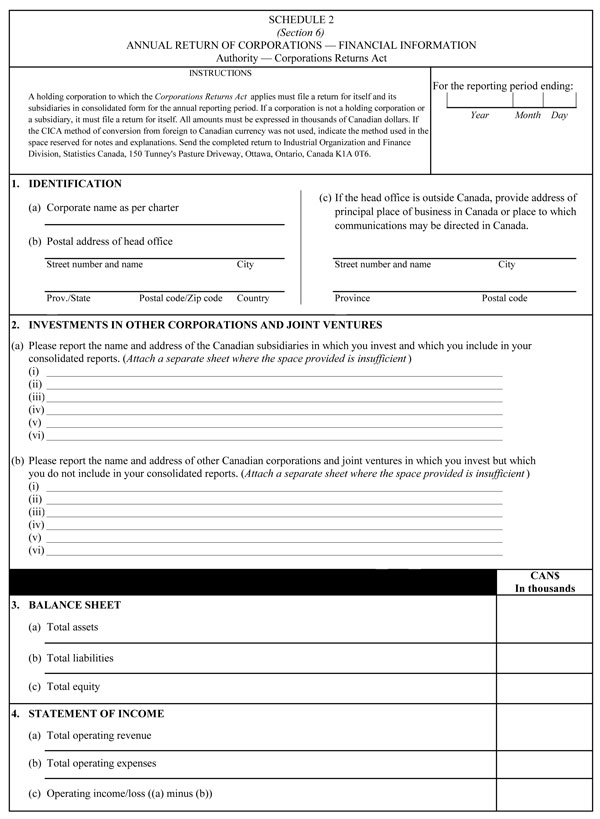

- provide an updated Financial Information Schedule (now Schedule 2); and

- remove Schedule IV (Transfer of Technology) and all references to it.

5. Consultation

These proposals have been discussed with a number of stakeholders on a number of occasions and there has been no opposition to them. Over the period of July 2004 through August 2005, meetings and exchanges took place with stakeholders at Industry Canada, Investment Canada, Canadian Heritage, International Trade Canada and Finance Canada, as well as with divisions of Statistics Canada, on a number of proposed revisions to the Corporations Returns Act program at Statistics Canada, including the raising of the reporting thresholds. As work proceeded on the development and analysis of the proposed changes, the stakeholders have been kept informed. No concerns were raised.

Beginning with the second quarter 2006 public release, in August 2006, of the Inter-Corporate Ownership CD-ROM, a product resulting from the Corporations Returns Act program, users were informed of the proposed changes to the reporting thresholds. There have been more than 20 releases of this product with this notification included and no concerns have been raised.

6. Small business lens

As small businesses are not subject to the Corporations Returns Act, this section is not applicable.

7. Rationale

Raising the reporting thresholds

The Act was enacted in 1962 to collect financial and ownership information on corporations conducting business in Canada. This information is used to evaluate the extent of non-resident control in the Canadian economy. In 1962, the Act required corporations to complete an Ownership Return if, individually or in combination with their affiliates, they had assets totalling more than $250,000 or operating revenues in excess of $500,000. (see footnote 2) At that time, the number of corporations or groups of affiliated corporations to which Statistics Canada mailed the Ownership Returns was roughly 25 000.

Over the years, as the thresholds for inclusion remained static, the number of corporations required to file returns under the Act has increased considerably, due to inflation, drawing many smaller corporations into the reporting population. This resulted in an amendment to the Act in 1981 whereby the thresholds were raised to $10 million in assets and $15 million in operating revenues. In addition, corporations with foreign debt or equity in excess of $200,000 were also required to file a return. These changes reduced the number of businesses that were subject to the reporting requirements of the Act to levels similar to those of 1962.

Since the 1981 amendment to the Act, the reporting thresholds have not changed. Consequently, the number of corporations that are subject to the Act has grown to approximately 56 600, at a collective ongoing cost to them of nearly $2 million annually or a net present value of about $14.5 million, with many smaller corporations being required to file Ownership Returns while not having any foreign ownership or control. For this reason, it is proposed that new reporting thresholds be prescribed in the proposed Regulations, raising the thresholds to revenues of more than $200 million, assets in excess of $600 million or foreign debt and equity over $1 million. With these changes, approximately 32 000 fewer corporations or groups of affiliated corporations in Canada would be required to file returns, with the collective savings to corporations estimated at $1.2 million annually or a net present value of $8.2 million over 10 years. At the same time, the impact on estimates of foreign control would be insignificant, as 99% of total foreign-controlled assets and 98% of total foreign-controlled revenues would still be covered.

Reflecting previous amendments to the Act

In 1998, the Act was amended to exclude unions, given that foreign control of unions was no longer of concern to Canada. It was also renamed the Corporations Returns Act. The proposed Regulations would also exclude unions and include updated references to the Act (i.e. to refer to it as the Corporations Returns Act).

In addition, the proposed Regulations would no longer include references to repealed portions of the Act, reflecting the changes made in the 1981 and 1998 amendments to the Act.

The proposed Regulations would also update references to provisions of the Act. For instance, section 4 of the existing Regulations refers to section 4.1 of the Act; however, that provision of the proposed Regulations would now correctly refer to section 5 of the Act.

Finally, the French version of the proposed Regulations would use the words “personne morale” and “personnes morales,” respectively, rather than “corporation” and “corporations,” as in the existing Regulations, to reflect the terminology used in the Act.

Schedules

The proposed Regulations would contain a more up-to-date version of the Ownership Schedule, now renumbered as “Schedule 1,” reflecting changes to the Act and the Regulations and changes in terminology over time, such as the use of the words “personne morale” rather than “corporation” in French.

Statistics Canada ceased using Schedule IV (Transfer of Technology) in 2003. This schedule collected information on transfers of technology from non-residents such as amounts paid for scientific research and development, and royalties and fees for patents, licenses, industrial designs and other related payments. It was originally added in the mid-eighties to satisfy the data requirements of the science program at Statistics Canada. However, Schedule IV did not prove to be a good vehicle for the collection of research and development data.

8. Implementation, enforcement and service standards

Once the proposed Regulations are in place, all information about the program, including materials on the Statistics Canada Web site, completion guides, etc., would be updated to reflect the new thresholds. The Ownership Return, which is prescribed under subsection 4(1) of the Act, would be updated to reflect the proposed changes.

9. Contact

Paula Thomson

Director

Industrial Organization and Finance Division

Statistics Canada

Jean Talon Building, 10th Floor, Section B8

150 Tunney’s Pasture Driveway

Ottawa, Ontario

K1A 0T6

Telephone: 613-951-2198

Fax: 613-951-0318

Email: paula.thomson@statcan.gc.ca

PROPOSED REGULATORY TEXT

Notice is hereby given, pursuant to subsection 23(2) of the Corporations Returns Act (see footnote a), that the Governor in Council, pursuant to paragraphs 23(1)(b), (c) (see footnote b) and (f) of that Act, proposes to make the annexed Corporations Returns Regulations.

Interested persons may make representations concerning the proposed Regulations within 90 days after the date of publication of this notice. All such representations must cite the Canada Gazette, Part Ⅰ, and the date of publication of this notice, and be addressed to Paula Thomson, Director, Industrial Organization and Finance Division, Statistics Canada, 150 Tunney’s Pasture Driveway, Ottawa, Ontario K1A 0T6 (tel.: 613-951-2198; fax: 613-951-0318; email: paula.thomson@statcan.gc.ca).

Ottawa, August 20, 2012

JURICA ČAPKUN

Assistant Clerk of the Privy Council

CORPORATIONS RETURNS REGULATIONS

INTERPRETATION

1. In these Regulations, “Act” means the Corporations Returns Act.

CALCULATING GROSS REVENUE AND ASSETS

2. (1) For the purpose of subparagraph 3(1)(a)(i) of the Act, the gross revenue of a corporation for a reporting period from the business carried on by it in Canada must, depending on the method ordinarily used by the corporation in computing its profits, be determined by adding together the amounts received or the amounts receivable in that period by reason of that business, other than as or on account of capital.

(2) For the purpose of subparagraph 3(1)(a)(ii) of the Act, the assets of a corporation as of the last day of a reporting period must be determined

- (a) in the case of a corporation resident in Canada, by adding together the value of each of its assets that was included in its balance sheet prepared as of the last day of the reporting period in accordance with generally accepted accounting principles; and

- (b) in the case of any other corporation, by adding together the value of each of its assets that was included in its balance sheet prepared as of the last day of the reporting period in accordance with generally accepted accounting principles and was

- (i) situated in Canada on the last day of the reporting period, and

- (ii) used in the reporting period primarily for the purpose of the business carried on by the corporation in Canada.

PRESCRIBED AMOUNTS FOR THE PURPOSES OF PARAGRAPHS 3(1)(a) AND (b) OF THE ACT

3. (1) For the purpose of subparagraph 3(1)(a)(i) of the Act, the prescribed greater amount is two hundred million dollars.

(2) For the purpose of subparagraph 3(1)(a)(ii) of the Act, the prescribed greater amount is six hundred million dollars.

(3) For the purpose of paragraph 3(1)(b) of the Act, the prescribed greater amount is one million dollars.

EXEMPTED CORPORATIONS

4. A corporation is exempt from the application of section 5 of the Act if it has filed

- (a) a Quarterly Survey of Financial Statements under the Statistics Act in accordance with that Act; or

- (b) a T2 Corporation Income Tax Return under the Income Tax Act in accordance with that Act — including, if applicable, Schedule 9, Related and Associated Corporations — using the General Index of Financial Information (GIFI) codes.

RETURNS

5. The return required to be filed under subsection 4(1) of the Act must be in the form set out in Schedule 1 and must include the information required in that form.

6. The return required to be filed under subsection 5(1) or (2) of the Act, must be in the form set out in Schedule 2 and must include the information required in that form.

FEES

7. The prescribed fee for inspecting, on application, the information referred to in section 16 of the Act is, in respect of information contained in the returns of

- (a) 10 or fewer corporations, $1 for each corporation;

- (b) 11 to 20 corporations, $10 plus 50 cents for each corporation in excess of 10; and

- (c) more than 20 corporations, $15 plus 10 cents for each corporation in excess of 20.

REPEAL

8. The Corporations and Labour Unions Returns Act Regulations (see footnote 3) are repealed.

COMING INTO FORCE

9. These Regulations come into force on the day on which they are registered.

[34-1-o]