Canada Gazette, Part I, Volume 153, Number 20: Proposed Statement of Royalties to Be Collected by SOCAN for the Public Performance or the Communication to the Public by Telecommunication, in Canada, of Musical or Dramatico-Musical Works

May 18, 2019

COPYRIGHT BOARD

Proposed Statement of Royalties to Be Collected by SOCAN for the Public Performance or the Communication to the Public by Telecommunication, in Canada, of Musical or Dramatico-Musical Works

In accordance with subsection 67.1(5) of the Copyright Act, the Copyright Board hereby publishes the proposed statement of royalties filed by the Society of Composers, Authors and Musical Publishers of Canada (SOCAN) on March 28, 2019, with respect to royalties it proposes to collect, effective January 1, 2020, for the public performance or the communication to the public by telecommunication, in Canada, of musical or dramatico-musical works.

In accordance with the provisions of the same subsection, the Board hereby gives notice that prospective users or their representatives who wish to object to the proposed statement of royalties may file written objections with the Board, at the address indicated below, within 60 days of the publication hereof, that is no later than July 17, 2019.

Ottawa, May 18, 2019

Gilles McDougall

Secretary General

56 Sparks Street, Suite 800

Ottawa, Ontario

K1A 0C9

613‑952‑8624 (telephone)

613‑952‑8630 (fax)

gilles.mcdougall@cb-cda.gc.ca (email)

PROPOSED STATEMENT OF ROYALTIES TO BE COLLECTED BY THE SOCIETY OF COMPOSERS, AUTHORS AND MUSIC PUBLISHERS OF CANADA (SOCAN)

in compensation for the right to perform in public or to communicate to the public by telecommunication, in Canada, musical or dramatico-musical works forming part of its repertoire, including the right to make such works available to the public by telecommunication in a way that allows a member of the public to have access to them from a place and at a time individually chosen by that member of the public.

GENERAL PROVISIONS

All amounts payable under these tariffs are exclusive of any federal, provincial or other governmental taxes or levies of any kind.

As used in these tariffs, the terms “licence,” “licence to perform” and “licence to communicate to the public by telecommunication” mean a licence to perform in public or to communicate to the public by telecommunication or to authorize the performance in public or the communication to the public by telecommunication, including the right to make works available to the public by telecommunication in a way that allows a member of the public to have access to them from a place and at a time individually chosen by that member of the public.

Except where otherwise specified, fees payable for any licence granted by SOCAN shall be due and payable upon grant of the licence. Any amount not received by the due date shall bear interest from that date until the date the amount is received. Interest shall be calculated daily, at a rate equal to one per cent above the Bank Rate effective on the last day of the previous month (as published by the Bank of Canada). Interest shall not compound.

Each licence shall subsist according to the terms set out therein. SOCAN shall have the right at any time to terminate a licence for breach of terms or conditions upon 30 days’ notice in writing.

Tariff No. 1

RADIO

A. Commercial Radio

Short Title

1. This tariff may be cited as the Commercial Radio Tariff (SOCAN: 2020-21; Re:Sound (…); CSI (…); Connect/SOPROQ (…); Artisti (…)).

Definitions

2. In this tariff,

- “Act” means the Copyright Act; (« Loi »)

- “collective societies” means SOCAN, Re:Sound, CSI, Connect/SOPROQ and Artisti; (« sociétés de gestion »)

- “gross income” means the gross amounts paid by any person for the use of one or more broadcasting services or facilities provided by a station’s operator, including the value of any goods or services provided by any person in exchange for the use of such services or facilities, and the fair market value of non-monetary consideration (e.g. barter or “contra”), but excluding the following:

- (a) income accruing from investments, rents or any other business unrelated to the station’s broadcasting activities. However, income accruing to or from any allied or subsidiary business, income accruing to or from any business that is a necessary adjunct to the station’s broadcasting services or facilities, or income accruing to or from any other business that results in the use of such services or facilities, including the gross amounts received by a station pursuant to turn-key contracts with advertisers, shall be included in the station’s “gross income”;

- (b) amounts received for the production of a program that is commissioned by someone other than the station and which becomes the property of that person;

- (c) the recovery of any amount paid to obtain the exclusive national or provincial broadcast rights to a sporting event, if the station can establish that the station was also paid normal fees for station time and facilities; and

- (d) amounts received by an originating station acting on behalf of a group of stations, which do not constitute a permanent network and which broadcast a single event, simultaneously or on a delayed basis, that the originating station subsequently pays out to the other stations participating in the broadcast. These amounts paid to each participating station are part of that station’s “gross income.”

- This definition is understood to include any income from simulcast; (« revenus bruts »)

- “ingest copy” means a reproduction of a sound recording of a musical work made for the purpose of ingesting that sound recording into a radio station’s broadcast system; (« copie d’incorporation »)

- “live performance copy” means a reproduction made by a radio station of a live performance of one or more musical works that occurs either at the radio station or at a remote location, but excludes any live performance embodied in a published sound recording; (« copie de prestation en direct »)

- “low-use station (sound recordings)” means a station that

- (a) broadcasts published sound recordings of musical works for less than 20 per cent of its total broadcast time (excluding production music) during the reference month; and

- (b) keeps and makes available to Re:Sound, Connect/SOPROQ and Artisti complete recordings of its last 90 broadcast days; (« station utilisant peu d’enregistrements sonores »)

- “low-use station (works)” means a station that

- (a) broadcasts works in the repertoire of SOCAN for less than 20 per cent of its total broadcast time (excluding production music) during the reference month; and

- (b) keeps and makes available to SOCAN and CSI complete recordings of its last 90 broadcast days; (« station utilisant peu d’œuvres »)

- “month” means a calendar month; (« mois »)

- “performer’s performance” means a performer’s performance that has been fixed with the authorization of the performer; (« prestation »)

- “production music” means music used in interstitial programming such as commercials, public service announcements and jingles; (« musique de production »)

- “reference month” means the second month before the month for which royalties are being paid; (« mois de référence »)

- “service provider” means a professional service provider which may be retained by a collective society to assist in the conduct of an audit or in the distribution of royalties to rights holders; (« prestataire de services »)

- “simulcast” means the simultaneous, unaltered, real-time streaming of the over-the-air broadcast signal of the station, or of another station that is part of the same network as the station, via the Internet or other similar digital network; (« diffusion simultanée »)

- “voice-tracking copy” means a reproduction of a sound recording of a musical work made to facilitate the making of a spoken-word recording to be broadcast in association with that sound recording; (« copie de préenregistrement vocal »)

- “year” means a calendar year. (« année »)

Application

3. (1) This tariff sets the royalties to be paid each month by commercial radio stations

- (a) in connection with the over-the-air broadcasting operations of a station

- (i) to communicate to the public by telecommunication in Canada musical or dramatico-musical works in the repertoire of SOCAN and published sound recordings embodying musical works and performers’ performances of such works in the repertoire of Re:Sound, and

- (ii) to reproduce in Canada musical works in the repertoire of CMRRA or SODRAC, sound recordings in the repertoire of Connect or SOPROQ and performers’ performances in the repertoire of Artisti; and

- (b) in connection with a simulcast, to communicate to the public by telecommunication in Canada musical or dramatico-musical works in the repertoire of SOCAN and to reproduce in Canada musical works in the repertoire of CMRRA or SODRAC.

(2) This tariff also entitles a station to authorize a person to communicate to the public by telecommunication a musical work, sound recording or performer’s performance and to reproduce a musical work or performer’s performance for the purpose of delivering it to the station, so that the station can use it as permitted in subsection (1).

(3) This tariff does not

- (a) authorize the use of any reproduction made pursuant to subsection (1) in association with a product, service, cause or institution; or

- (b) apply to a communication to the public by telecommunication that is subject to another tariff, including SOCAN Tariff 16, 22 or 25, Re:Sound Tariff 8, the Satellite Radio Services Tariff or the SOCAN-Re:Sound Pay Audio Services Tariff.

4. This tariff is subject to the special royalty rates set out in subparagraph 68.1(1)(a)(i) of the Act.

Royalties

| SOCAN | Re:Sound | CSI | Connect/ SOPROQ |

Artisti | |

|---|---|---|---|---|---|

| on the first $625,000 gross income in a year | 1.5% | (…)% | (…)% | (…)% | (…)% |

| on the next $625,000 gross income in a year | 1.5% | (…)% | (…)% | (…)% | (…)% |

| on the rest | 1.5% | (…)% | (…)% | (…)% | (…)% |

| SOCAN | Re:Sound | CSI | Connect/ SOPROQ |

Artisti | |

|---|---|---|---|---|---|

| on the first $625,000 gross income in a year | 3.2% | (…)% | (…)% | (…)% | (…)% |

| on the next $625,000 gross income in a year | 3.2% | (…)% | (…)% | (…)% | (…)% |

| on the rest | 4.4% | (…)% | (…)% | (…)% | (…)% |

7. All royalties payable under this tariff are exclusive of any federal, provincial or other governmental taxes or levies of any kind.

Administrative Provisions

8. (1) No later than the first day of each month, a station shall

- (a) pay the royalties for that month;

- (b) report the station’s gross income for the reference month;

- (c) provide to CSI, for the reference month, the gross income from any simulcast, as well as the number of listeners and listening hours or, if not available, any other available indication of the extent of the listeners’ use of simulcast; and

- (d) provide to the collective societies the sequential lists of all musical works and published sound recordings, or parts thereof, broadcast during each day of the reference month. For greater clarity, sequential list reporting requires full music use reporting for each day of the month, for 365 days per year.

(2) On September 1 and March 1, a station electing to benefit from the discount factors X and Y referred to in sections 5 and 6 shall report to CSI, Connect/SOPROQ and Artisti the values A, B, C and D and provide all the information necessary to assess the level of compliance of the station with section 30.9 of the Act for the six-month periods ending on June 30 and December 31, respectively.

9. At any time during the period set out in subsection 11(2), a collective society may require the production of any contract granting rights referred to in paragraph (c) of the definition of “gross income,” together with the billing or correspondence relating to the use of these rights by other parties.

Information on Repertoire Use

10. (1) Each entry provided under paragraph 8(1)(d) shall include the following information, where available:

- (a) the date of the broadcast;

- (b) the time of the broadcast;

- (c) the title of the sound recording;

- (d) the title of the musical work;

- (e) the title of the album;

- (f) the catalogue number of the album;

- (g) the track number on the album;

- (h) the record label;

- (i) the name of the author and composer;

- (j) the name of all performers or the performing group;

- (k) the duration of the sound recording broadcast, in minutes and seconds;

- (l) the duration of the sound recording as listed on the album, in minutes and seconds;

- (m) the Universal Product Code (UPC) of the album;

- (n) the International Standard Recording Code (ISRC) of the sound recording; and

- (o) the cue sheets for syndicated programming, with the relevant music use information inserted into the report.

(2) The information set out in subsection (1) shall be provided in electronic format (Excel format or any other format agreed upon by the collective societies and the station), where possible, with a separate field for each piece of information required in subsection (1) other than the cue sheets which are to be used to insert the relevant music use information into each field of the report.

(3) For certainty, the use of the expression “where available” in subsection (1) means that all the listed information in the station’s possession or control, regardless of the form or the way in which it was obtained, must mandatorily be provided to the collective societies.

Records and Audits

11. (1) A station shall keep and preserve, for a period of six months after the end of the month to which they relate, records from which the information set out in subsection 10(1) can be readily ascertained.

(2) A station shall keep and preserve, for a period of six years after the end of the year to which they relate, records from which the station’s gross income can be readily ascertained.

(3) A station shall keep and preserve, for a period of six months after the end of the period to which they relate, records from which the information set out in subsection 8(2) can be readily ascertained.

(4) A collective society may audit the records referred to in subsections (1) and (2) at any time during the period set out therein, on reasonable notice and during normal business hours. The collective society shall, upon receipt, supply a copy of the report of the audit to the station that was the object of the audit and to the other collective societies.

(5) Any of CSI, Connect, SOPROQ and Artisti may audit the records referred to in subsection (3) at any time during the period set out therein, on reasonable notice and during normal business hours. The collective society shall, upon receipt, supply a copy of the report of the audit to the station that was the object of the audit and may also supply a copy of the report to one or more of the other collective societies on request.

(6) If an audit discloses that royalties due have been understated in any month by more than 10 per cent, the station shall pay the reasonable costs of the audit within 30 days of the demand for such payment.

Confidentiality

12. (1) Subject to subsections (2), (3) and (4), information received from a station pursuant to this tariff shall be treated in confidence, unless the station that supplied the information consents in writing and in advance to each proposed disclosure of the information.

(2) Information referred to in subsection (1) may be shared

- (a) amongst the collective societies and their service providers to the extent required by the service providers for the service they are contracted to provide;

- (b) with the Copyright Board;

- (c) in connection with proceedings before the Board, if the station had the opportunity to request that it be protected by a confidentiality order;

- (d) to the extent required to effect the distribution of royalties, with royalty claimants; or

- (e) if required by law.

(3) Where confidential information is shared with service providers as per paragraph (2)(a), those service providers shall sign a confidentiality agreement which shall be shared with the affected station prior to the release of the information.

(4) Subsection (1) does not apply to information that is publicly available, or to information obtained from someone other than the station that supplied the information and who is not under an apparent duty of confidentiality to that station with respect to the supplied information.

Adjustments

13. Adjustments in the amount of royalties owed (including excess payments), as a result of the discovery of an error or otherwise, shall be made on the date the next royalty payment is due.

Interest on Late Payments

14. Any amount not received by the due date shall bear interest from that date until the date the amount is received. Interest shall be calculated daily, at a rate equal to one per cent above the Bank Rate effective on the last day of the previous month (as published by the Bank of Canada). Interest shall not compound.

Addresses for Notices, etc.

15. (1) Anything addressed to SOCAN shall be sent to 41 Valleybrook Drive, Toronto, Ontario M3B 2S6, email: licence@socan.com, fax number: 416‑445‑7108, or to any other address, email address or fax number of which a station has been notified in writing.

(2) Anything addressed to Re:Sound shall be sent to 1235 Bay Street, Suite 900, Toronto, Ontario M5R 3K4, email: radio@resound.ca, fax number: 416‑962‑7797, or to any other address, email address or fax number of which a station has been notified in writing.

(3) Anything addressed to CSI shall be sent to 1470 Peel Street, Tower B, Suite 1010, Montréal, Quebec H3A 1T1, email: csi@cmrrasodrac.ca, fax number: 514‑845‑3401, or to any other address, email address or fax number of which a station has been notified in writing.

(4) Anything addressed to Connect shall be sent to 85 Mowat Avenue, Toronto, Ontario M6K 3E3, email: radioreproduction@connectmusic.ca, fax number: 416‑967‑9415, or to any other address, email address or fax number of which a station has been notified in writing.

(5) Anything addressed to SOPROQ shall be sent to 6420 Saint-Denis Street, Montréal, Quebec H2S 2R7, email: radioreproduction@soproq.org, fax number: 514‑842‑7762, or to any other address, email address or fax number of which a station has been notified in writing.

(6) Anything addressed to Artisti shall be sent to 1441 René-Lévesque Boulevard W, Suite 400, Montréal, Quebec H3G 1T7, email: radiorepro@uda.ca, fax number: 514‑288‑7875, or to any other address, email address or fax number of which a station has been notified in writing.

(7) Anything addressed to a station shall be sent to the last address, email address or fax number of which a collective society has been notified in writing.

Delivery of Notices and Payments

16. (1) Royalties payable to Connect/SOPROQ are paid to Connect. All other information to which Connect/SOPROQ is entitled pursuant to this tariff is delivered to Connect and SOPROQ separately.

(2) A notice may be delivered by file transfer protocol (FTP), by hand, by postage-paid mail, by email or by fax. A payment must be delivered by hand, by postage-paid mail, or by electronic bank transfer (EBT), provided that the associated reporting is provided concurrently to the collective society by email.

(3) Information set out in sections 8 and 10 shall be sent by email.

(4) Anything mailed in Canada shall be presumed to have been received four business days after the day it was mailed.

(5) Anything sent by fax, email, FTP or EBT shall be presumed to have been received the day it was transmitted.

B. Non-Commercial Radio Other than the Canadian Broadcasting Corporation

For a licence to perform over the air or over the Internet, at any time and as often as desired in the year 2021, for private and domestic use, any or all of the works in SOCAN’s repertoire by a non-commercial AM, FM or Internet-only radio station other than a station of the Canadian Broadcasting Corporation, the fee payable is 1.9 per cent of the station’s gross operating costs in the year covered by the licence. For greater certainty, “the station’s gross operating costs” includes its gross Internet operating costs.

No later than January 31 of the year covered by the licence, the licensee shall pay the estimated fee owing for that year. The payment shall be accompanied by a report of the station’s actual gross operating costs for the previous year. The fee is subject to adjustment when the actual gross operating costs for the year covered by the licence have been determined and reported to SOCAN.

If broadcasting takes place for less than the entire year, an application must be made for a licence by the end of the first month of broadcasting on the form to be supplied by SOCAN and, together with the application form, the station shall forward its remittance for the estimated fee payable.

For the purpose of this tariff item, “non-commercial AM, FM or Internet-only radio station” shall include any station that is non-profit or not-for-profit, whether or not any part of its operating expenses is funded by advertising revenues.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff 1.B does not apply to the use of music covered by Tariff 26 [the Pay Audio Services Tariff].

C. Canadian Broadcasting Corporation

Short Title

1. This tariff may be cited as the SOCAN-Re:Sound CBC Radio Tariff, 2020-2022.

Application

2. This tariff sets the royalties to be paid by CBC for the communication to the public by telecommunication, in Canada, for private or domestic use, of musical works in the repertoire of SOCAN and of published sound recordings embodying musical works and performers’ performances of such works in the repertoire of Re:Sound, by over-the-air radio broadcasting and by simulcasting of an over-the-air radio signal.

Royalties

3. (1) CBC shall pay, per month, on the first day of each month, $157,118.47 plus 4.4 per cent of any “gross income” in connection with the above uses for the reference month, as that term is defined in SOCAN Tariff 1.A (Commercial Radio), to SOCAN and (…) to Re:Sound.

(2) The royalties set in subsection (1) are exclusive of any applicable federal, provincial or other governmental taxes or levies of any kind.

Interest on Late Payments

4. Any amount not received by the due date shall bear interest from that date until the date the amount is received. Interest shall be calculated daily at a rate equal to one per cent above the Bank Rate effective on the last day of the previous month (as published by the Bank of Canada). Interest shall not compound.

Music Use Information

5. (1) Each month, CBC shall provide to both SOCAN and Re:Sound the following information in respect of each musical work, or part thereof, and each sound recording embodying a musical work, or part thereof, broadcast by each of CBC’s conventional radio stations, as may be applicable:

- (a) the date, time, duration of the broadcast of the musical work and sound recording, and the type of broadcast (e.g. local, regional);

- (b) the title of the work and the name of its author, composer and arranger;

- (c) the type of usage (e.g. feature, theme, background);

- (d) the title and catalogue number of the album, the name of the main performer or performing group and the record label, and whether the track performed is a published sound recording;

- (e) the name of the program, station (including call letters) and location of the station on which the musical work or sound recording was broadcast; and

- (f) where possible, the International Standard Musical Work Code (ISWC) of the work, the Universal Product Code (UPC) of the album, the International Standard Recording Code (ISRC) of the sound recording, the names of all of the other performers (if applicable), the duration of the musical work and sound recording as listed on the album and the track number on the album.

(2) The information set out in subsection (1) shall be provided electronically, in Excel format or in any other format agreed upon by SOCAN, Re:Sound and CBC, with a separate field for each piece of information required in paragraphs (a) to (f), no later than 15 days after the end of the month to which it relates.

Tariff No. 2

TELEVISION

A. Commercial Television Stations

Definitions

1. In this tariff,

- “ambient music” means music unavoidably picked up in the background when an event is videotaped or broadcasted. (« musique ambiante »)

- “cleared music” means any music, other than ambient music or production music, in respect of which a station does not require a licence from SOCAN. (« musique affranchie »)

- “cleared program” means

- (a) if the only cleared music contained in the program is music that was cleared before 60 days after the publication of this tariff, a program containing no music other than cleared music, ambient music or production music; and

- (b) if not, a program produced by a Canadian programming undertaking and containing no music other than cleared music, ambient music or production music. (« émission affranchie »)

- “gross income” means the gross amounts paid by any person for the use of one or more broadcasting services or facilities provided by the station’s operator, whether such amounts are paid to the station owner or operator or to other persons, excluding the following:

- (a) any such amounts received by a person other than the operator or owner of the station which form part of the base for calculation of the SOCAN royalty payable by such other person under this or another tariff;

- (b) income accruing from investments, rents or any other business unrelated to the station’s broadcasting activities. However, income accruing from any allied or subsidiary business that is a necessary adjunct to the station’s broadcasting services and facilities or which results in their being used shall be included in the “gross income”;

- (c) amounts received for the production of a program that is commissioned by someone other than the licensee and which becomes the property of that person;

- (d) the recovery of any amount paid to obtain the exclusive national or provincial broadcast rights to a sporting event, if the licensee can establish that the station was also paid normal fees for station time and facilities. SOCAN may require the production of the contract granting these rights together with the billing or correspondence relating to the use of these rights by other parties; and

- (e) amounts received by an originating station acting on behalf of a group of stations, which do not constitute a permanent network and which broadcast a single event, simultaneously or on a delayed basis, that the originating station pays out to the other stations participating in the broadcast. These amounts paid to each participating station are part of that station’s “gross income.” (« revenus bruts »)

- “production music” means music contained in interstitial programming such as commercials, public service announcements and jingles. (« musique de production »)

- “programming undertaking” means a programming undertaking as defined in the Broadcasting Act, S.C. 1991, c. 11. (« entreprise de programmation »)

Application

2. (1) This tariff applies to licences for the communication to the public by telecommunication by a broadcast television station, at any time and as often as desired, in the year 2021, for private or domestic use, of any or all of the works in SOCAN’s repertoire.

(2) This tariff does not apply to stations owned and operated by the Canadian Broadcasting Corporation or licensed under a different tariff.

Election of Licence

3. (1) A station can elect for the standard or modified blanket licence.

(2) A station’s election must be in writing and must be received by SOCAN at least 30 days before the first day of the month for which the election is to take effect.

(3) A station’s election remains valid until it makes a further election.

(4) A station can make no more than two elections in a calendar year.

(5) A station that has never made an election is deemed to have elected for the standard blanket licence.

Standard Blanket Licence

4. (1) A station that has elected for the standard blanket licence shall pay 1.9 per cent of the station’s gross income for the second month before the month for which the licence is issued.

(2) No later than the day before the first day of the month for which the licence is issued, the station shall pay the fee, and report the station’s gross income for the second month before the month for which the licence is issued.

Modified Blanket Licence (MBL)

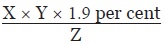

5. (1) A station that has elected for the modified blanket licence shall pay the amount calculated in accordance with Form A (found at the end of this Supplement).

(2) No later than the last day of the month after the month for which the licence is issued, the station shall

- (a) provide to SOCAN, using Form A, a report of the calculation of its licence fee;

- (b) provide to SOCAN, using Form B (found at the end of this Supplement), reports identifying, in respect of each cleared program, the music used in that program;

- (c) provide to SOCAN any document supporting its claim that the music identified in Form B is cleared music, or a reference to that document, if the document was provided previously; and

- (d) pay the amount payable pursuant to subsection (1).

Audit Rights

6. SOCAN shall have the right to audit any licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements and reports rendered and the fee payable by the licensee.

MBL: Incorrect Cleared Program Claims

7. Amounts paid pursuant to lines C and D of Form A on account of a program that a station incorrectly claimed as a cleared program are not refundable.

B. Ontario Educational Communications Authority

For a licence to perform, at any time and as often as desired in the years 2021 and 2022, for private or domestic use, any or all of the works in SOCAN’s repertoire by

- (a) a station operated by the Ontario Educational Communications Authority; and

- (b) the websites and other technological platforms (e.g. Internet, iPod, mobile phones, iPad) operated by the Authority, the annual fee is $360,096 payable in equal quarterly instalments on January 1, April 1, July 1 and October 1 of the year covered by the licence.

Tariff 2.B does not apply to the use of music covered under Tariff 17.

C. Société de télédiffusion du Québec

For a licence to perform, at any time and as often as desired in the years 2021 and 2022, for private or domestic use, any or all of the works in SOCAN’s repertoire by

- (a) a station operated by the Société de télédiffusion du Québec (STQ); and

- (b) the websites and other technological platforms (e.g. Internet, iPod, mobile phones, iPad) operated by the STQ, i.e. uses that would otherwise be the subject of SOCAN Tariff 22.E, the annual fee is $216,000 payable in equal quarterly instalments on March 31, June 30, September 30 and December 15 of the year covered by the licence.

Tariff 2.C does not apply to the use of music covered under Tariff 17.

D. Canadian Broadcasting Corporation

For a licence to perform, at any time and as often as desired in the years 2020-2022, for private or domestic use, any or all of the works in SOCAN’s repertoire for all broadcasts of programs by the television network and stations owned and operated by the Canadian Broadcasting Corporation, the annual fee shall be $8,273,699.65, payable in equal monthly instalments on the first day of each month, commencing January 1 of the year for which the licence is issued.

Tariff 2.D does not apply to the use of music covered under Tariff 17 or Tariff 22.

Tariff No. 3

CABARETS, CAFES, CLUBS, COCKTAIL BARS, DINING ROOMS, LOUNGES, RESTAURANTS, ROADHOUSES, TAVERNS AND SIMILAR ESTABLISHMENTS

A. Live Music

For a licence to perform, by means of performers in person, at any time and as often as desired in the years 2020-2021, any or all of the works in SOCAN’s repertoire, in cabarets, cafes, clubs, cocktail bars, dining rooms, lounges, restaurants, roadhouses, taverns and similar establishments, the fee payable by the establishment is 3 per cent of the compensation for entertainment paid in the year covered by the licence, subject to a minimum annual fee of $89.76.

“Compensation for entertainment” means the total amounts paid by the licensee to, plus any other compensation received by, musicians, singers and all other performers, for entertainment of which live music forms part. It does not include expenditures for stage props, lighting equipment, set design and costumes, or expenditures for renovation, expansion of facilities or furniture and equipment.

No later than January 31 of the year covered by the licence, the licensee shall pay to SOCAN the estimated fee owing for that year, as follows. If any music was performed as part of entertainment in the previous year, the payment is based on the compensation paid for entertainment during that year, and accompanied by a report of the actual compensation paid for entertainment during that year. If no music was performed as part of entertainment in that year, the licensee shall file a report estimating the expected compensation for entertainment during the year covered by the licence and pay according to that report.

No later than January 31 of the following year, the licensee shall file with SOCAN a report of the actual compensation paid for entertainment during the previous year and an adjustment of the licence fee shall be made accordingly. Any monies owed shall then be paid to SOCAN; if the fee due is less than the amount paid, SOCAN shall credit the licensee with the amount of the overpayment.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

B. Recorded Music Accompanying Live Entertainment

For a licence to perform, by means of recorded music, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, as an integral part of live entertainment in cabarets, cafes, clubs, cocktail bars, dining rooms, lounges, restaurants, roadhouses, taverns and similar establishments, the fee payable by the establishment shall be 2 per cent of the compensation for entertainment paid in the year covered by the licence, subject to a minimum annual fee of $67.32.

“Compensation for entertainment” means the total amounts paid by the licensee to, plus any other compensation received by, all performers, for entertainment of which recorded music forms an integral part. It does not include expenditures for stage props, lighting equipment, set design and costumes, or expenditures for renovation, expansion of facilities or furniture and equipment.

No later than January 31 of the year covered by the licence, the licensee shall pay to SOCAN the estimated fee owing for that year, as follows. If any music was performed as part of entertainment in the previous year, the payment is based on the compensation paid for entertainment during that year, and accompanied by a report of the actual compensation paid for entertainment during that year. If no music was performed as part of entertainment in that year, the licensee shall file a report estimating the expected compensation for entertainment during the year covered by the licence and pay according to that report.

No later than January 31 of the following year, the licensee shall file with SOCAN a report of the actual compensation paid for entertainment during the previous year and an adjustment of the licence fee shall be made accordingly. Any monies owed shall then be paid to SOCAN; if the fee due is less than the amount paid, SOCAN shall credit the licensee with the amount of the overpayment.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff 3.B does not apply to the use of music covered under Tariff 3.C.

C. Adult Entertainment Clubs

For a licence to perform, by means of recorded music, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, in an adult entertainment club, the fee payable by the establishment is 4.7¢ per day, multiplied by the capacity (seating and standing) authorized under the establishment’s liquor licence or any other document issued by a competent authority for this type of establishment.

“Day” means any period between 6:00 a.m. on one day and 6:00 a.m. the following day during which the establishment operates as an adult entertainment club.

No later than January 31 of the year covered by the licence, the licensee shall file a report estimating the amount of royalties and send to SOCAN the report and the estimated fee.

No later than January 31 of the following year, the licensee shall file with SOCAN a report indicating the authorized capacity (seating and standing) of the establishment, as well as the number of days it operated as an adult entertainment club during the previous year, and an adjustment of the licence fee shall be made accordingly. Any additional monies owed shall then be paid to SOCAN; if the fee due is less than the amount paid, SOCAN shall credit the licensee with the amount of the overpayment.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 4

LIVE PERFORMANCES AT CONCERT HALLS, THEATRES AND OTHER PLACES OF ENTERTAINMENT

A. Popular Music Concerts

1. Per Event Licence

For a licence to perform, by means of performers in person at a concert in the years 2020 and 2021, any or all of the works in SOCAN’s repertoire, at concert halls, theatres and other places where entertainment is presented, including open-air events, the fee payable per concert is as follows:

- (a) 3 per cent of gross receipts from ticket sales of paid concerts, exclusive of any applicable taxes, with a minimum fee per concert of $35; or

- (b) 3 per cent of fees paid to singers, musicians, dancers, conductors and other performers during a free concert, with a minimum fee per concert of $35.

For greater certainty, Tariff 4.A.1 applies to the performance of musical works by lip synching or miming.

“Free concert” includes, with respect to festivals, celebrations and other similar events, a concert for which no separate admission charge is made.

“Performers” include DJs when they are the featured performer and their identity forms part of material used to promote the event.

Administrative Provisions

No later than 30 days after the concert, the licensee shall

- (a) pay the royalties due for the concert;

- (b) report the gross receipts from the ticket sales or the total fees paid to the performers, including all singers, musicians, dancers, conductors, and other performers, as may be applicable;

- (c) provide the legal names, addresses and telephone numbers of the concert promoters, if any, and the owners of the venue where the concert took place (if other than the licensee);

- (d) provide the name of the act(s) at the concert, if available; and

- (e) provide the title of each musical work performed, if available.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff 4.A.1 does not apply to performances covered under Tariff 3.A or Tariff 22.

2. Annual Licence

For an annual licence to perform, by means of performers in person at a concert in the years 2020 and 2021, any or all of the works in SOCAN’s repertoire, at concert halls, theatres and other places where entertainment is presented, including open-air events, the fee payable per concert is as follows:

- (a) 3 per cent of gross receipts from ticket sales of paid concerts, exclusive of any applicable taxes, with a minimum annual fee of $60; or

- (b) 3 per cent of fees paid to singers, musicians, dancers, conductors and other performers during a free concert, with a minimum annual fee of $60.

For greater certainty, Tariff 4.A.2 applies to the performance of musical works by lip synching or miming.

“Free concert” includes, with respect to festivals, celebrations and other similar events, a concert for which no separate admission charge is made.

“Performers” include DJs when they are the featured performer and their identity forms part of material used to promote the event.

Administrative Provisions

No later than 30 days after each concert, the licensee shall

- (a) provide the legal names, addresses and telephone numbers of the concert promoters, if any, and of the owners of the venue where the concert took place (if other than the licensee);

- (b) provide the name of the act(s) at the concert, if available; and

- (c) provide the title of each musical work performed, if available.

The licensee shall estimate the fee payable for the year for which the licence is issued, based on the total gross receipts/fees paid for the previous year, and shall pay such estimated fee to SOCAN on or before January 31 of the year for which the licence is issued. Payment of the fee shall be accompanied by a report of the gross receipts/fees paid for the previous year.

If the gross receipts/fees paid reported for the previous year were not based on the entire year, payment of this fee shall be accompanied by a report estimating the gross receipts/fees paid for the entire year for which the licence is issued.

On or before January 31 of the following year, a report shall be made of the actual gross receipts/fees paid during the calendar year for which the licence is issued, an adjustment of the licence fee payable to SOCAN shall be made, and any additional fees due on the basis of the actual gross receipts/fees paid. If the fee due is less than the amount paid, SOCAN shall credit the licensee with the amount of the overpayment.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff 4.A.2 does not apply to performances covered under Tariff 3.A or Tariff 22.

B. Classical Music Concerts

1. Per Concert Licence

For a licence to perform, by means of performers in person at a concert in the years 2020 and 2021, any or all of the works in SOCAN’s repertoire, at concerts or recitals of classical music, the fee payable per concert is as follows:

- (a) 1.56 per cent of gross receipts from ticket sales of paid concerts, exclusive of any applicable taxes, with a minimum fee per concert of $35; or

- (b) 1.56 per cent of fees paid to singers, musicians, dancers, conductors and other performers during a free concert, with a minimum fee per concert of $35.

For greater certainty, Tariff 4.B.1 applies to the performance of musical works by lip synching or miming.

“Free concert” includes, with respect to festivals, celebrations and other similar events, a concert for which no separate admission charge is made.

Administrative Provisions

No later than 30 days after the concert, the licensee shall

- (a) pay the royalties due for the concert;

- (b) report the gross receipts from the ticket sales or the total fees paid to the performers, including all singers, musicians, dancers, conductors, and other performers, as may be applicable;

- (c) provide the legal names, addresses and telephone numbers of the concert promoters, if any, and of the owners of the venue where the concert took place (if other than the licensee);

- (d) provide the name of the act(s) at the concert, if available; and

- (e) provide the title of each musical work performed, if available.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

2. Annual Licence for Orchestras

| Annual Orchestra Budget | Annual Fee × Total Number of Concerts |

|---|---|

| $0 to $100,000 | $73 |

| $100,001 to $500,000 | $117 |

| $500,001 to $1,000,000 | $191 |

| $1,000,001 to $2,000,000 | $238 |

| $2,000,001 to $5,000,000 | $398 |

| $5,000,001 to $10,000,000 | $436 |

| Over $10,000,000 | $477 |

“Orchestras” include a musical group which offers to the public one or more series of concerts or recitals that have been predetermined in an annual budget.

Included in the “total number of concerts” are the ones where no work of SOCAN’s repertoire is performed.

Where fees are paid under this tariff, no fees shall be payable under Tariff 4.B.1.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

3. Annual Licence for Presenting Organizations

For an annual licence to perform, by means of performers in person at a concert in the years 2020 and 2021, any or all of the works in SOCAN’s repertoire during a series of concerts or recitals of classical music forming part of an artistic season of a presenting organization, the fee payable per concert is as follows:

0.96 per cent of gross receipts from ticket sales, subscription and membership revenues, for all concerts (including concerts where no work of SOCAN’s repertoire is performed), exclusive of any applicable taxes, with a minimum annual fee of $35.

Where a series of concerts and recitals forming part of a presenting organization’s artistic season is free of charge, the fee payable is as follows:

0.96 per cent of fees paid to singers, musicians, dancers, conductors, and other performers, for all concerts (including concerts where no work of SOCAN’s repertoire is performed) in the series, with a minimum annual fee of $35.

For greater certainty, Tariff 4.B.3 applies to the performance of musical works by lip synching or miming.

No later than 30 days after each concert, the licensee shall

- (a) provide the legal names, addresses and telephone numbers of the concert promoters, if any, and of the owners of the venue where the concert took place (if other than the licensee);

- (b) provide the name of the act(s) at the concert, if available; and

- (c) provide the title of each musical work performed, if available.

No later than January 31 of the year for which the licence is issued, the licensee shall file with SOCAN a report estimating the gross receipts from ticket sales, subscription and membership revenues for that year. For a series of free concerts and recitals, the licensee shall file a report estimating the fees paid to singers, musicians, dancers, conductors, and other performing artists for all concerts in the series. If the estimated payment is $100 or less, payment shall accompany the report. Otherwise, payments based on the report’s estimate shall be made quarterly within 30 days of the end of each quarter.

No later than January 31 of the following year, the licensee shall file with SOCAN a report of the actual gross receipts from ticket sales, subscription and membership revenues or, for a series of free concerts and recitals, the fees paid to singers, musicians, dancers, conductors and other performing artists, during the year for which the licence is issued, and an adjustment of the licence fee shall be paid to SOCAN. Any amount due shall accompany the report; if the fee due is less than the amount paid, SOCAN shall credit the licensee with the amount of the overpayment.

Where fees are paid under this tariff, no fees shall be payable under Tariff 4.B.1.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 5

EXHIBITIONS AND FAIRS

A. For a licence to perform, at any time and as often as desired, any or all of the works in SOCAN’s repertoire at an exhibition or fair held in the year 2021, the fee is calculated as follows:

- (a) where the total attendance (excluding exhibitors and staff) for the duration of the exhibition or fair does not exceed 75 000 persons

Total Attendance Fee Payable per Day Up to 25 000 persons $13.75 25 001 to 50 000 persons $27.66 50 001 to 75 000 persons $69.00 - (b) where the total attendance (excluding exhibitors and staff) for the duration of the exhibition or fair exceeds 75 000 persons

Total Attendance Fee Payable per Person For the first 100 000 persons 1.15¢ For the next 100 000 persons 0.50¢ For the next 300 000 persons 0.38¢ All additional persons 0.28¢

In the case of an exhibition or fair that is scheduled yearly, the fee shall be paid on the actual attendance figures in the preceding year, on or before January 31 of the year covered by the licence. The licensee shall submit with the licence fee the figures for actual attendance for the previous year and the duration, in days, of the exhibition or fair.

In all other cases, the licensee shall, within 30 days of an exhibition’s or fair’s closing, report its attendance and duration and submit the fee based on those figures.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

A licence issued under Tariff 5.A does not authorize performances of music at concerts for which an additional admission charge is made; for such concerts, Tariff 5.B applies.

B. Where an additional admission charge is made for attendance at musical concerts, an additional licence shall be required. The fee payable for such licence in the year 2021 is calculated at the rate of 3 per cent of gross receipts from ticket sales to the concert, exclusive of any applicable taxes. Where the concert ticket allows the purchaser access to the exhibition grounds at any time after the opening on the day of the concert, the adult general grounds admission price shall also be deducted from the ticket price to produce the net ticket price.

The fees due under section B shall be calculated on a per concert basis and shall be payable immediately after the close of the exhibition.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 6

MOTION PICTURE THEATRES

For a licence to perform, at any time and as often as desired in the years 2020 and 2021, any or all of the works in SOCAN’s repertoire, covering the operations of a motion picture theatre or any establishment exhibiting motion pictures at any time during the year, the annual fee is as follows:

0.25 per cent of gross receipts from ticket sales, exclusive of any applicable taxes, with a minimum annual fee of $300 per screen.

A licence obtained under this tariff does not authorize any concert or other performance of music when the exhibition of one or more films is not an integral part of the program. The fees for those performances shall be calculated under other applicable tariffs.

The licensee shall estimate the fee payable for the year for which the licence is issued, based on the total gross receipts from ticket sales for the previous year, and shall pay such estimated fee to SOCAN on or before January 31 of the year for which the licence is issued. Payment of the fee shall be accompanied by a report of the gross receipts from ticket sales for the previous year.

If the gross receipts from ticket sales reported for the previous year were not based on the entire year, payment of this fee shall be accompanied by a report estimating the gross receipts/fees paid for the entire year for which the licence is issued.

On or before January 31 of the following year, a report shall be made of the actual gross receipts from ticket sales during the calendar year for which the licence is issued, an adjustment of the licence fee payable to SOCAN shall be made, and any additional fees due on the basis of the actual gross receipts/fees paid. If the fee due is less than the amount paid, SOCAN shall credit the licensee with the amount of the overpayment.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 7

SKATING RINKS

For a licence to perform, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, by means of performers in person or by means of recorded music, in connection with roller or ice skating, the fee is as follows:

- (a) where an admission fee is charged: 1.2 per cent of the gross receipts from admissions exclusive of sales and amusement taxes, subject to a minimum annual fee of $111.92; and

- (b) where no admission fee is charged: an annual fee of $111.92.

The licensee shall estimate the fee payable for the year covered by the licence based on the total gross receipts from admissions, exclusive of sales and amusement taxes, for the previous year and shall pay such estimated fee to SOCAN on or before January 31 of the year covered by the licence. Payment of the fee shall be accompanied by a report of the gross receipts for the previous year.

If the gross receipts reported for the previous year were not based on the entire year, payment of this fee shall be accompanied by a report estimating the gross receipts from admissions for the entire year covered by the licence.

On or before January 31 of the following year, a report shall be made of the actual gross receipts from admissions during the year covered by the licence, an adjustment of the licence fee payable to SOCAN shall be made, and any additional fees due on the basis of the actual gross receipts from admission charges shall be paid to SOCAN. If the fee due is less than the amount paid, SOCAN shall credit the licensee with the amount of the overpayment.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 8

RECEPTIONS, CONVENTIONS, ASSEMBLIES AND FASHION SHOWS

| Room Capacity (seating and standing) |

Fee per Event | |

|---|---|---|

| Without Dancing | With Dancing | |

| 1–100 | $22.06 | $44.13 |

| 101–300 | $31.72 | $63.49 |

| 301–500 | $66.19 | $132.39 |

| Over 500 | $93.78 | $187.55 |

No later than 30 days after the end of each quarter, the licensee shall file with SOCAN a report for that quarter of the actual number of events with and without dancing and of the number of days on which a fashion show was held. The report shall also include the room capacity (seating and standing) authorized under the establishment’s liquor licence or any other document issued by a competent authority for this type of establishment, and payment of the licence fees.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 9

SPORTS EVENTS

For a licence to perform, at any time and as often as desired for the year 2020, any or all of the works in SOCAN’s repertoire, by means of performers in person or by means of recorded music, in connection with baseball, football, hockey, basketball, skating competitions, races, track meets and other sports events, the fee payable per event shall be 0.1 per cent of gross receipts from ticket sales, exclusive of sales and amusement taxes.

The fee payable for an event to which the admission is free is $5.

A complimentary ticket is valued at half the lowest price paid for a sold ticket from the same ticket category in the same event.

No later than 30 days after the end of each quarter, the licensee shall file with SOCAN a report for that quarter of the actual number of events, together with payment of the licence fees.

A licence to which Tariff 9 applies does not authorize performances of music at opening and closing events for which an additional admission charge is made; for such events, Tariff 4 shall apply.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 10

PARKS, PARADES, STREETS AND OTHER PUBLIC AREAS

A. Strolling Musicians and Buskers; Recorded Music

For a licence to perform, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, by strolling musicians or buskers, or by means of recorded music, in parks, streets or other public areas, the fee is as follows:

$34.93 for each day on which music is performed, up to a maximum fee of $239.21 in any three-month period.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

For concert performances in parks, streets or other public areas, Tariff 4 shall apply.

B. Marching Bands; Floats with Music

For a licence to perform, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, by marching bands or floats with music participating in parades, the fee is as follows:

$9.42 for each marching band or float with music participating in the parade, subject to a minimum fee of $34.93 per day.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 11

CIRCUSES, ICE SHOWS, FIREWORKS DISPLAYS, SOUND AND LIGHT SHOWS AND SIMILAR EVENTS; COMEDY SHOWS AND MAGIC SHOWS

A. Circuses, Ice Shows, Fireworks Displays, Sound and Light Shows and Similar Events

For a licence to perform, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, by means of performers in person or by means of recorded music at circuses, ice shows, fire-works displays, multimedia shows (including sound and light) and similar events, the fee payable per event is as follows:

1.6 per cent of gross receipts from ticket sales, exclusive of sales and amusement taxes, subject to a minimum fee of $66.37.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

B. Comedy Shows and Magic Shows

For a licence to perform, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, by means of performers in person or by means of recorded music in conjunction with events where the primary focus is on comedians or magicians and the use of music is incidental, the fee payable per event is $39.27. However, where the comedy act or magic show is primarily a musical act, Tariff 4.A applies.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 12

THEME PARKS, ONTARIO PLACE CORPORATION AND SIMILAR OPERATIONS; PARAMOUNT CANADA’S WONDERLAND AND SIMILAR OPERATIONS

A. Theme Parks, Ontario Place Corporation and Similar Operations

For a licence to perform, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, at theme parks, Ontario Place Corporation and similar operations, the fee payable is

- (a) $2.59 per 1 000 persons in attendance on days on which music is performed, rounding the number of persons to the nearest 1 000;

PLUS

- (b) 1.5 per cent of “live music entertainment costs.”

“Live music entertainment costs” means all direct expenditures of any kind and nature (whether in money or other form) paid by the licensee or on the licensee’s behalf for all live entertainment during which live music is performed on the premises. It does not include amounts expended for stage props, lighting equipment, set design and costumes, or expenditures for renovation, expansion of facilities or furniture and equipment.

No later than June 30 of the year covered by the licence, the licensee shall file with SOCAN a statement estimating the attendance and the live music entertainment costs for that year, together with payment of 50 per cent of the estimated fee. The balance of the estimated fee is to be paid no later than October 1 of the same year.

No later than the earliest of 30 days of the close of the season and January 31 of the following year, the licensee shall file with SOCAN an audited statement setting out the total attendance and the live music entertainment costs for the year covered by the licence. SOCAN shall then calculate the fee and submit a statement of adjustments.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff 12.A does not apply to performances covered under Tariff 4 or 5.

B. Paramount Canada’s Wonderland Inc. and Similar Operations

For a licence to perform, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire at Paramount Canada’s Wonderland and similar operations, the fee payable is

- (a) $5.60 per 1 000 persons in attendance on days on which music is performed, rounding the number of persons to the nearest 1 000;

PLUS

- (b) 1.5 per cent of “live music entertainment costs.”

“Live music entertainment costs” means all direct expenditures of any kind and nature (whether in money or other form) paid by the licensee or on the licensee’s behalf for all live entertainment during which live music is performed on the premises. It does not include amounts expended for stage props, lighting equipment, set design and costumes, or expenditures for renovation, expansion of facilities or furniture and equipment.

No later than June 30 of the year covered by the licence, the licensee shall file with SOCAN a statement estimating the attendance and the live music entertainment costs for that year, together with payment of 50 per cent of the estimated fee. The balance of the estimated fee is to be paid no later than October 1 of the same year.

No later than the earliest of 30 days of the close of the season and January 31 of the following year, the licensee shall file with SOCAN an audited statement setting out the total attendance and the live music entertainment costs for the year covered by the licence. SOCAN shall then calculate the fee and submit a statement of adjustments.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff 12.B does not apply to performances covered under Tariff 4 or 5.

Tariff No. 13

PUBLIC CONVEYANCES

A. Aircraft

For a licence to perform in an aircraft, by means of recorded music (including music in audiovisual programming), at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, the annual fee payable for each aircraft owned or operated by the licensee is calculated as follows:

- 1. Music while on the ground: $2.32 per seat for each aircraft in service during the year, prorated to the number of days in which the aircraft is in service during the year.

- 2. Music as part of in-flight programming: $5.49 per seat for each aircraft in service during the year, prorated to the number of days in which the aircraft is in service during the year.

Where fees for an aircraft are paid under Tariff 13.A.2, no fees are payable for that aircraft under Tariff 13.A.1.

For the purpose of this Tariff, an aircraft is not “in service” if it is no longer owned, leased or under contract by the licensee or during any period of 15 consecutive days or more that it has not been used to carry the licensee’s passengers due to maintenance necessary for regulatory compliance.

The licensee shall estimate the fee payable for the year for which the licence is issued, based on the total seating capacity of all aircraft owned or operated by it during the previous year, and shall pay such estimated fee to SOCAN on or before January 31 of the year for which the licence is issued. Payment of the fee shall be accompanied by the report required in the next paragraph.

On or before January 31, a report shall be provided showing the number of aircraft operated by the licensee during the preceding year, as well as, for each aircraft, its seating capacity, the dates of any 15 consecutive days or more that it was not used to carry the licensee’s passengers due to maintenance necessary for regulatory compliance, and the applicable Tariff 13.A item (13.A.1 or 13.A.2). Any adjustment of the licence fee payable to SOCAN from the estimated amount previously paid shall be made and any additional fees due on the basis of the actual seating capacity shall be paid at that time. If the fee due is less than the estimated amount previously paid, SOCAN shall credit the licensee with the amount of the overpayment.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

B. Passenger Ships

For a licence to perform in a passenger ship, by means of recorded music, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, the fee payable for each passenger ship is as follows:

$1.13 per person per year, based on the authorized passenger capacity of the ship, subject to a minimum annual fee of $67.32.

For passenger ships operating for less than 12 months in each year, the fee payable shall be reduced by one twelfth for each full month during the year in which no operations occur.

On or before January 31 of the year covered by the licence, the licensee shall report the authorized passenger capacity and pay the applicable fee to SOCAN.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

C. Railroad Trains, Buses and Other Public Conveyances, Excluding Aircraft and Passenger Ships

For a licence to perform in railroad trains, buses and other public conveyances, excluding aircraft and passenger ships, by means of recorded music, at any time and as often as desired in the years 2021 and 2022, any or all of the works in SOCAN’s repertoire, the fee payable is as follows:

$1.13 per person per year, based on the authorized passenger capacity of the car, bus or other public conveyance, subject to a minimum annual fee of $67.32.

On or before January 31 of the year covered by the licence, the licensee shall report the authorized passenger capacity and pay the applicable fee to SOCAN.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 14

PERFORMANCE OF AN INDIVIDUAL WORK

For the performance, in the year 2021, of an individual work or an excerpt therefrom by a performer or contrivance at any single event when that work is the sole work performed from the repertoire of SOCAN, the fee payable shall be as follows:

| Potential Audience | Musical Group or Orchestra with or without Vocal Accompaniment | Single Instrument with or without Vocal Accompaniment |

|---|---|---|

| 500 or less | $5.35 | $2.72 |

| 501 to 1 000 | $6.27 | $4.11 |

| 1 001 to 5 000 | $13.37 | $6.68 |

| 5 001 to 10 000 | $18.66 | $9.36 |

| 10 001 to 15 000 | $24.01 | $12.03 |

| 15 001 to 20 000 | $29.30 | $14.65 |

| 20 001 to 25 000 | $34.60 | $17.33 |

| 25 001 to 50 000 | $40.05 | $17.48 |

| 50 001 to 100 000 | $45.45 | $22.72 |

| 100 001 to 200 000 | $59.33 | $26.63 |

| 200 001 to 300 000 | $66.68 | $33.31 |

| 300 001 to 400 000 | $79.94 | $39.95 |

| 400 001 to 500 000 | $93.36 | $46.68 |

| 500 001 to 600 000 | $106.67 | $53.26 |

| 600 001 to 800 000 | $119.94 | $59.58 |

| 800 001 or more | $133.25 | $66.68 |

| Increase | (%) |

|---|---|

| Over 3 and not more than 7 minutes | 75 |

| Over 7 and not more than 15 minutes | 125 |

| Over 15 and not more than 30 minutes | 200 |

| Over 30 and not more than 60 minutes | 300 |

| Over 60 and not more than 90 minutes | 400 |

| Over 90 and not more than 120 minutes | 500 |

If more than one work from SOCAN’s repertoire is performed during any particular event, the fees shall be calculated under other applicable tariffs.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Tariff No. 15

BACKGROUND MUSIC IN ESTABLISHMENTS NOT COVERED BY TARIFF NO. 16

A. Background Music

For a licence to perform recorded music forming part of SOCAN’s repertoire, by any means, including a television set, and at any time and as often as desired in the years 2020 and 2021, any or all of the works in SOCAN’s repertoire, in an establishment not covered by Tariff 16, the annual fee is $1.53 per square metre or 14.28¢ per square foot, payable no later than January 31 of the year covered by the licence.

If no music is performed in January of the first year of operation, the fee shall be prorated on a monthly basis, calculated from the month in which music was first performed, and shall be paid within 30 days of the date on which music was first performed.

Seasonal establishments operating less than six months per year shall pay half the above-mentioned rate.

In all cases, a minimum annual fee of $117.75 shall apply.

The payment shall be accompanied by a report showing the area of the establishment.

This tariff does not cover the use of music expressly covered in other tariffs, including performances covered under Tariff 8.

Pursuant to subsection 69(2) of the Copyright Act, no royalties are collectable from the owner or user of a radio receiving set in respect of public performances effected by means of that radio receiving set in any place other than a theatre that is ordinarily and regularly used for entertainments to which an admission charge is made.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

B. Telephone Music on Hold

For a licence to communicate to the public by telecommunication over a telephone on hold, at any time and as often as desired in the years 2020 and 2021, any or all of the works in SOCAN’s repertoire, in an establishment not covered by Tariff 16, the fee payable is as follows:

$117.75 for one trunk line, plus $2.60 for each additional trunk line.

For the purposes of this tariff, “trunk line” means a telephone line linking the licensee’s telephone switching equipment to the public telephone system and over which music is provided to a caller while on hold.

No later than January 31 of the year covered by the licence, the licensee shall pay the applicable fee to SOCAN and report the number of trunk lines.

SOCAN shall have the right to audit the licensee’s books and records, on reasonable notice and during normal business hours, to verify the statements rendered and the fee payable by the licensee.

Where fees are paid under Tariff 16, subsection 3(2), no fees shall be payable under Tariff 15.

Tariff No. 16

BACKGROUND MUSIC SUPPLIERS

Definitions

1. In this tariff,

- “quarter” means from January to March, from April to June, from July to September and from October to December. (« trimestre »)

- “revenues” means any amount paid by a subscriber to a supplier. (« recettes »)

- “small cable transmission system” has the meaning attributed to it in sections 3 and 4 of the Definition of “Small Cable Transmission System” Regulations, SOR/94-755 (Canada Gazette, Part II, Vol. 128, page 4096), amended by SOR/2005-148 (Canada Gazette, Part II, Vol. 139, page 1195). (« petit système de transmission par fil »)

- “supplier” means a background music service supplier. (« fournisseur »)

Application

2. (1) This tariff sets the royalties payable in the years 2020 and 2021 by a supplier who communicates to the public by telecommunication works in SOCAN’s repertoire or authorizes a subscriber to perform such works in public as background music, including making such works available to the public by telecommunication in a way that allows a member of the public to have access to them from a place and at a time individually chosen by that member of the public, and including any use of music with a telephone on hold or by means of a television set.

(2) This tariff does not cover the use of music expressly covered in other tariffs, including performances covered under SOCAN Tariffs 8 and 19 and the Pay Audio Services Tariff.

Royalties

3. (1) Subject to subsection (4), a supplier who communicates a work in SOCAN’s repertoire during a quarter pays to SOCAN 2.25 per cent of revenues from subscribers who received such a communication during the quarter, subject to a minimum fee of $1.75 per relevant premises.

(2) Subject to subsections (3) and (4), a supplier who authorizes a subscriber to perform in public a work in SOCAN’s repertoire during a quarter pays to SOCAN 7.5 per cent of revenues from subscribers so authorized during the quarter, subject to a minimum fee of $5.85 per relevant premises.

(3) A supplier who authorizes a subscriber to perform in public a work in SOCAN’s repertoire is not required to pay the royalties set out in subsection (2) to the extent that the subscriber complies with SOCAN Tariff 15.

(4) Royalties payable by a small cable transmission system are reduced by half.

Reporting Requirements

4. (1) No later than 60 days after the end of the quarter, the supplier shall pay the royalty for that quarter and shall report the information used to calculate the royalty.

(2) A supplier subject to subsection 3(1) shall provide with its payment the sequential lists of all musical works transmitted on the last seven days of each month of the quarter. Each entry shall mention the date and time of transmission, the title of the musical work, the name of the author and the composer of the work, the name of the performer or of the performing group, the running time, in minutes and seconds, the title of the record album, the record label, the Universal Product Code (UPC) and the International Standard Recording Code (ISRC).

(3) The information set out in subsection (2) is provided only if it is available to the supplier or to a third party from whom the supplier is entitled to obtain the information.

(4) A supplier subject to subsection 3(1) is not required to comply with subsection (2) with respect to any signal that is subject to the Pay Audio Services Tariff.

(5) A supplier subject to subsection 3(2) shall provide with its payment the name of each subscriber and the address of each premises for which the supplier is making a payment.

(6) Information provided pursuant to this section shall be delivered electronically, in plain text format or in any other format agreed upon by SOCAN and a supplier.

(7) A small cable transmission system is not required to comply with subsections (2) to (4).

Records and Audits

5. SOCAN shall have the right to audit the supplier’s books and records, on reasonable notice during normal business hours, to verify the statements rendered and the fee payable by the supplier.

Confidentiality

6. (1) Subject to subsections (2) and (3), SOCAN shall treat in confidence information received pursuant to this tariff, unless the person who supplied the information consents in writing to the information being treated otherwise.

(2) SOCAN may share information referred to in subsection (1)

- (a) with the Copyright Board;

- (b) in connection with proceedings before the Copyright Board, if the supplier had the opportunity to request a confidentiality order;

- (c) to the extent required to effect the distribution of royalties, with any other collective society or with any royalty claimant; or