Vol. 149, No. 8 — April 22, 2015

Registration

SOR/2015-75 April 1, 2015

CANADA DEPOSIT INSURANCE CORPORATION ACT

By-law Amending the Canada Deposit Insurance Corporation Differential Premiums By-law

The Minister of Finance, pursuant to subsection 21(3) (see footnote a) of the Canada Deposit Insurance Corporation Act (see footnote b), approves the annexed By-law Amending the Canada Deposit Insurance Corporation Differential Premiums By-law, made by the Board of Directors of the Canada Deposit Insurance Corporation.

Ottawa, March 26, 2015

JOE OLIVER

Minister of Finance

The Board of Directors of the Canada Deposit Insurance Corporation, pursuant to paragraph 11(2)(g) (see footnote c) and subsection 21(2) (see footnote d) of the Canada Deposit Insurance Corporation Act (see footnote e), makes the annexed By-law Amending the Canada Deposit Insurance Corporation Differential Premiums By-law.

Ottawa, December 3, 2014

BY-LAW AMENDING THE CANADA DEPOSIT INSURANCE CORPORATION DIFFERENTIAL PREMIUMS BY-LAW

AMENDMENTS

1. (1) Subsection 1(1) of the Canada Deposit Insurance Corporation Differential Premiums By-law (see footnote 1) is amended by adding the following in alphabetical order:

“domestic systemically important bank” means a bank designated as such by the Superintendent. (banque d’importance systémique nationale)

“guidelines for member institutions” means the Guidelines for Banks or the Guidelines for Trust and Loan Companies, as applicable. (lignes directrices à l’intention des institutions membres)

(2) Subsections 1(2) and (3) of the By-law are replaced by the following:

(2) Unless otherwise provided in this By-law, terms and expressions used in this By-law have the same meaning as in the guidelines for member institutions or in the Reporting Manual.

(3) For the purpose of determining the annual premium of a member institution for a premium year, a reference in this By-law to the guidelines for member institutions or the Reporting Manual is a reference to those guidelines or that Reporting Manual as amended up to and including October 31 preceding that premium year.

2. The description of C in paragraph 3(b) of the By-law is replaced by the following:

C is the percentage set out in column 3 of Schedule 1 for the applicable premium year for premium category 1.

3. The description of C in paragraph 4(1)(b) of the By-law is replaced by the following:

C is the percentage set out for the applicable premium year in column 3 of an item of Schedule 1 that corresponds to the premium category of the member institution set out in column 1 of that item.

4. Paragraphs 6(1)(a) and (b) of the By-law are replaced by the following:

- (a) if the institution is an institution described in paragraph 12(1)(a), audited financial statements and a revised Reporting Form or a declaration that the audited financial statements confirm the information set out in the Reporting Form and no modifications are required to be made to the Reporting Form or to the returns and documents referred to in paragraphs 15(1)(c) and (e) as previously submitted; and

- (b) if the institution is an institution described in paragraph 12(1)(b), the declaration referred to in paragraph 7(1)(b) or the documents required by paragraphs 15(1)(a) to (c) and (e) or section 16.

5. Subsection 12(1) of the By-law is replaced by the following:

12. (1) Despite sections 8, 8.1, 8.2, 9 and 11, a member institution shall be classified in premium category 4 as set out in column 1 of Schedule 1 if it

- (a) has submitted a Reporting Form in accordance with paragraph 15(4)(a) or 16(2)(a), as the case may be, but has not, before July 1 of the filing year, submitted audited financial statements and a revised Reporting Form or a declaration that the audited financial statements confirm the information set out in the Reporting Form and no modifications are required to be made to the Reporting Form or to the returns and documents referred to in paragraphs 15(1)(c) and (e), as previously submitted; or

- (b) has not, by April 30 of the filing year, submitted the declaration referred to in paragraph 7(1)(b) or the documents required by paragraphs 15(1)(a) to (c) and (e) or section 16.

6. Subsection 14(3) of the By-law is repealed.

7. (1) Paragraphs 15(1)(c) and (d) of the By-law are replaced by the following:

- (c) the Basel III Capital Adequacy Reporting – Credit, Market and Operational Risk return, set out on the website of the Office of the Superintendent of Financial Institutions, completed in accordance with the guidelines for member institutions, as of the end of each of its two preceding fiscal years, that is, as of the end of the fiscal year ending in the year preceding the filing year and the end of the fiscal year ending in the second year preceding the filing year, unless the return has been previously submitted to the Corporation;

(2) Subparagraphs 15(1)(e)(i) to (vi) of the By-law are replaced by the following:

- (i) the Consolidated Statement of Income, Retained Earnings and AOCI, completed in accordance with that Manual, for its preceding fiscal year,

- (ii) the Return of Impaired Assets, completed in accordance with that Manual as of the end of its preceding fiscal year,

- (iii) the Consolidated Monthly Balance Sheet, completed in accordance with that Manual as of the end of its preceding fiscal year,

- (iv) Section III of the Mortgage Loans Report, completed in accordance with that Manual as of the end of its preceding fiscal year,

- (v) the Non-Mortgage Loans Report, completed in accordance with that Manual as of the end of its preceding fiscal year, and

- (vi) the Pledging and REPOS Report, completed in accordance with that Manual as of the end of its preceding fiscal year; and

(3) Paragraph 15(1)(f) of the By-law is replaced by the following:

- (f) the audited financial statements on which the information provided in the Reporting Form and the returns and documents referred to in paragraphs (c) and (e) are based, unless those financial statements have been submitted to the Corporation under the Canada Deposit Insurance Corporation Deposit Insurance Policy By-law.

(4) The portion of subsection 15(2) of the By-law before paragraph (a) is replaced by the following:

(2) The information provided by a member institution in the Reporting Form and in the returns and documents referred to in paragraphs (1)(c) and (e) must

(5) Subsection 15(3) of the By-law is replaced by the following:

(3) Unless otherwise provided in this By-law, financial information that is provided under this By-law shall be prepared in accordance with the International Financial Reporting Standards established by the International Accounting Standards Board, the primary source of which is, in Canada, the CPA Canada Handbook – Accounting.

(6) Paragraph 15(4)(a) of the By-law is replaced by the following:

- (a) complete the Reporting Form and the returns and documents referred to in paragraphs (1)(c) and (e) based on its unaudited financial statements and submit them to the Corporation within the time required by subsection (1); and

(7) Subparagraphs 15(4)(b)(i) and (ii) of the By-law are replaced by the following:

- (i) provide the Corporation with a declaration that the audited financial statements confirm the information that was previously provided and that no modifications are required to be made to the Reporting Form or to the returns and documents referred to in paragraphs (1)(c) and (e) as previously submitted, or

- (ii) submit a revised Reporting Form and the returns and documents referred to in paragraphs (1)(c) and (e) in revised form if they have been revised to conform with the audited financial statements.

8. (1) Subparagraph 16(1)(b)(ii) of the By-law is replaced by the following:

- (ii) the Reporting Form and the returns referred to in paragraph 15(1)(c) and the documents referred to in paragraph 15(1)(e), which returns and documents must consist of information that is based on and consistent with the audited financial statements referred to in subparagraph (i), and must be based on consolidated financial information as of the day preceding the date of amalgamation.

(2) Subparagraphs 16(2)(b)(i) and (ii) of the By-law are replaced by the following:

- (i) provide the Corporation with a declaration that the audited financial statements confirm the information that was previously provided and that no modifications are required to be made to the Reporting Form or to the returns and documents referred to in paragraphs 15(1)(c) and (e) as previously submitted, or

- (ii) submit a revised Reporting Form and the returns and documents referred to in paragraphs 15(1)(c) and (e) in revised form if they have been revised to conform with the audited financial statements.

9. The portion of section 17 of the By-law before paragraph (a) is replaced by the following:

17. Section 15 does not apply to a member institution

10. Section 21 of the By-law is replaced by the following:

21. The Corporation shall assign to the member institution a score in respect of its capital adequacy that is equal to the sum of its scores for elements 1.2 and 1.4 of item 1 of the Reporting Form. To determine its scores for those elements, the Corporation shall compare the results obtained for the member institution in respect of its capital adequacy under elements 1.2 and 1.4 of that item with the range of results set out in Part 1 of Schedule 3.

11. The portion of section 25 of the By-law before paragraph (a) is replaced by the following:

25. The Corporation shall assign the score for the factor in item 8 of the Reporting Form to a member institution that is not a domestic systemically important bank as follows:

12. The By-law is amended by adding the following after section 25:

25.1 The Corporation shall assign the score for the factor in item 8-1 of the Reporting Form to a member institution that is a domestic systemically important bank as follows:

- (a) if the result of the threshold formula in element 8-1.1 of the Reporting Form is equal to or less than 100 per cent, the score to be assigned is 5; and

- (b) if the result of the threshold formula in element 8-1.1 of the Reporting Form is greater than 100 per cent, the score to be assigned is

- (i) 3, if the result of the formula in element 8-1.2 is less than 25 per cent; and

- (ii) 0, if the result of the formula in element 8-1.2 is equal to or greater than 25 per cent.

13. Schedule 1 to the By-law is replaced by the Schedule 1 set out in Schedule 1 to this By-law.

14. Paragraph (a) of the definition “Guidelines” in subsection 1(1) of Part 1 of Schedule 2 to the By-law is replaced by the following:

- (a) in the case of a bank or a federal credit union, the Guidelines for Banks; and

15. Item 1 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law is replaced by the following:

1. CAPITAL ADEQUACY MEASURES

1.1 Leverage Ratio

Formula:

Net on- and off-balance sheet assets

Total Capital for Purposes of ACM

Complete the following:

![]()

Elements

Use the instructions below to arrive at the elements of the formula.

Refer to the Basel III Capital Adequacy Reporting — Credit, Market and Operational Risk (BCAR) form, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year.

1.1.1 Net On- and Off-Balance Sheet Assets

Indicate the net on- and off-balance sheet assets as set out in Schedule 1 – Ratios and Assets to Capital Multiple Calculations of the BCAR form.

1.1.2 Total Capital for Purposes of ACM

Indicate the total capital for purposes of ACM as set out in Schedule 1 – Ratios and Assets to Capital Multiple Calculations of the BCAR form.

1.1.3 Multiple Authorized by the Regulator

For a federal member institution, indicate the assets to capital multiple authorized by the institution’s regulator.

For a provincial member institution, indicate the borrowing multiple or non-risk-weighted assets multiple authorized by the institution’s regulator. 1.1.3_______

1.2 Leverage Ratio Score

Use the scoring grid below to determine the member institutions’s leverage ratio score.

| Range of Scores for Leverage Ratio | Score |

|---|---|

| Leverage ratio (1.1) is ≤ 23 and ≤ 90% of the multiple authorized by the regulator (1.1.3) | 10 |

| Leverage ratio (1.1) is ≤ 23 and ≤ 100% of the multiple authorized by the regulator (1.1.3) | 7 |

| Leverage ratio (1.1) is > 23 or > 100% of the multiple authorized by the regulator (1.1.3) | 0 |

| 1.2 Leverage Ratio Score |

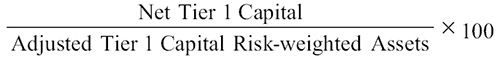

1.3 Tier 1 Capital Ratio (%)

Formula:

Complete the following:

![]()

Elements

Use the instructions below to arrive at the elements of the formula.

Refer to the Basel III Capital Adequacy Reporting — Credit, Market and Operational Risk (BCAR) form, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year.

1.3.1 Net Tier 1 Capital

Indicate the net tier 1 capital as set out in Schedule 1 – Ratios and Assets to Capital Multiple Calculations of the BCAR form.

1.3.2 Adjusted Tier 1 Capital Risk-Weighted Assets

Indicate the adjusted Tier 1 capital risk-weighted assets as set out in Schedule 1 – Ratios and Assets to Capital Multiple Calculations of the BCAR form.

1.3.3 Minimum Required Tier 1 Capital Ratio

Indicate the minimum required Tier 1 capital ratio set by the regulator.

1.3.4 “All in” Capital Target Tier 1 Capital Ratio

Indicate the “all in” capital target Tier 1 capital ratio (including the capital conservation buffer and domestic systemically important bank surcharge as applicable) set by the regulator.

1.4 Tier 1 Capital Ratio Score

Use the scoring grid below to determine the member institution’s Tier 1 Capital Ratio score.

| Range of Scores for Tier 1 Capital Ratio | Score |

|---|---|

| Tier 1 capital ratio (1.3) is > “all in” capital target Tier 1 capital ratio (1.3.4) set by the regulator for the member institution | 10 |

| Tier 1 capital ratio (1.3) is ≤ “all in” capital target Tier 1 capital ratio (1.3.4) set by the regulator for the member institution but > minimum Tier 1 capital ratio (1.3.3) required by the regulator | 6 |

| Tier 1 capital ratio (1.3) is < minimum Tier 1 capital ratio (1.3.3) required by the regulator | 0 |

| 1.4 Tier 1 Capital Ratio Score |

1.5 Capital Adequacy Score

Calculate the capital adequacy score by completing the following formula.

Formula:

Leverage Ratio Score + Tier 1 Capital Ratio Score = Capital Adequacy Score

Complete the following:

1.2 ________ + 1.4 ________ = 1.5 ________

1.5 Capital Adequacy Score

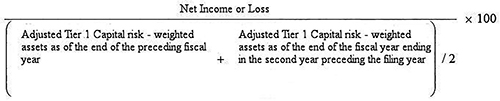

16. (1) The formula under the heading “Formula:” in item 2 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law is replaced by the following:

(2) The portion of item 2 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law beginning with the heading “Elements” and ending before the heading “Score” is replaced by the following:

Elements

Use the instructions below to arrive at the elements of the formula.

Refer to the following documents:

- (a) the Consolidated Statement of Comprehensive Income, Retained Earnings and AOCI, Reporting Manual, completed in accordance with that Manual as of the fiscal year ending in the year preceding the filing year; and

- (b) the Basel III Capital Adequacy Reporting — Credit, Market and Operational Risk (BCAR) form, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year.

2.1 Net Income or Loss

The net income or loss attributable to equity holders and non-controlling interests (the latter to be reported as a negative number) as set out in the Consolidated Statement of Comprehensive Income, Retained Earnings and AOCI.

2.2 Adjusted Tier 1 Capital Risk-Weighted Assets as of the End of the Preceding Fiscal Year

Indicate the adjusted Tier 1 Capital risk-weighted assets as set out in the BCAR form.

2.3 Adjusted Tier 1 Capital Risk-Weighted Assets as of the End of the Fiscal Year Ending in the Second Year Preceding the Filing Year

Calculate the adjusted Tier 1 Capital risk-weighted assets as of the end of the fiscal year ending in the second year preceding the filing year in the same manner as for element 2.2.

If the member institution did not report its adjusted Tier 1 Capital risk-weighted assets using the BCAR form as of the end of the fiscal year ending in the second year preceding the filing year, it must report the same amount as for element 2.2.

If the member institution does not have a fiscal year ending in the second year preceding the filing year, it must report “zero”, unless it is an amalgamated institution described below.

If the member institution is an amalgamated member institution formed by an amalgamation involving one or more member institutions and does not have a fiscal year ending in the second year preceding the filing year, it must report the same amount as for element 2.2.

17. Items 3 and 4 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law are replaced by the following:

3. MEAN ADJUSTED NET INCOME VOLATILITY

If a member institution has been operating as a member institution for less than five fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for elements 3, 3.1, 3.2 and 3.13 and fill in any of elements 3.3 to 3.12 that apply to it.

If a member institution has been operating as a member institution for more than five fiscal years but less than 10 fiscal years consisting of at least 12 months each (with the last fiscal year of operation ending in the year preceding the filing year), it must complete the formula using the fiscal years during which it has been operating with the appropriate adjustment to the value of “n”.

If a member institution formed by an amalgamation involving only one member institution has been operating as a member institution for less than three fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), in addition to filling in the applicable elements as an amalgamated member institution, it must also fill in the applicable elements for the amalgamating member institution.

If a member institution formed by an amalgamation involving two or more member institutions has been operating as a member institution for less than three fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for elements 3, 3.1, 3.2 and 3.13 and fill in any of elements 3.3 to 3.12 that apply to it.

Formula:

Standard deviation of the net income or loss

Mean net income or loss

Complete the following:

![]()

Elements

Use the instructions below to arrive at the elements of the formula.

3.1 Standard deviation of the Net Income or Loss

Determine the standard deviation of the net income or loss using the formula

![]()

If a member institution has been operating as a member institution for 12 or more fiscal years consisting of at least 12 months each, “n” will be equal to 10.

If a member institution has been operating as a member institution for seven or more but less than 12 fiscal years consisting of at least 12 months each, for each year that it is not operating the portion of the formula in the numerator referencing that year would be removed and “n” will be equal to the number of years that it has been so operating less 2 (e.g, if operating for 11 years, remove “(3.12 – 3.2)2” from the numerator and “n” will be equal to 9).

If a member institution has been operating as a member institution for six fiscal years consisting of at least 12 months each, “+ (3.7 – 3.2)2 + (3.8 – 3.2)2 + (3.9 – 3.2)2 + (3.10 – 3.2)2 + (3.11 – 3.2)2 + (3.12 – 3.2)2” must be removed from the formula and “n” will be equal to 4.

If a member institution has been operating as a member institution for five fiscal years consisting of at least 12 months each, “+ (3.6 – 3.2)2 + (3.7 – 3.2)2 + (3.8 – 3.2)2 + (3.9 – 3.2)2 + (3.10 – 3.2)2 + (3.11 – 3.2)2 + (3.12 – 3.2)2” must be removed from the formula and “n” will be equal to 3.

3.2 Mean Net Income or Loss

Determine the mean net income or loss (the latter to be reported as a negative number) using the formula

(3.3 + 3.4 + 3.5 + 3.6 + 3.7 + 3.8 + 3.9 + 3.10 + 3.11 + 3.12)

n

If a member institution has been operating as a member institution for 12 or more fiscal years consisting of at least 12 months each, “n” will be equal to 10.

If a member institution has been operating as a member institution for seven or more but less than 12 fiscal years consisting of at least 12 months each, the portion of the formula in the numerator referencing the years that it was not operating is to be removed and “n” will be equal to the number of years that it has been so operating less 2 (e.g., if operating for 11 years, “+ 3.12” is removed from the numerator and “n” will be equal to 9).

If a member institution has been operating as a member institution for six fiscal years consisting of at least 12 months each, “+ 3.7 + 3.8 + 3.9 + 3.10 + 3.11 + 3.12” must be removed from the formula and “n” will be equal to 4.

If a member institution has been operating as a member institution for five fiscal years consisting of at least 12 months each, “+ 3.6 + 3.7 + 3.8 + 3.9 + 3.10 + 3.11 + 3.12” must be removed from the formula and “n” will be equal to 3.

Net income or loss (the latter to be reported as a negative number) after tax for each of the last 10 fiscal years.

Indicate the net income or loss as determined for element 2.1 for the fiscal year ending in the year preceding the filing year. 3.3________

Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.3. 3.4________

Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.4. 3.5________

Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.5. 3.6________

Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.6. 3.7________

Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.7. 3.8________

Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.8. 3.9________

Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.9. 3.10________

Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.10. 3.11________

Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.11. 3.12________

Indicate the number of fiscal years that the member institution has been operating as a member institution (if less than 12). ________

A member institution must report net income or loss for the last 10 fiscal years.

If a member institution has been operating as a member institution for less than three fiscal years of at least 12 months each and it is a member institution formed by an amalgamation involving only one member institution, it must report the net income or loss of the amalgamating member institution for the three fiscal years or less preceding the amalgamation, as applicable.

If a member institution has been operating as a member institution for less than five fiscal years of at least 12 months each, it must report “N/A” (“not applicable”) for the elements corresponding to the fiscal years for which it was not operating as a member institution.

Score

Use the scoring grid below to determine the member institution’s score.

| Range of results | Score |

|---|---|

| Mean adjusted net income volatility (3) is ≥ 0 and ≤ 0.5 | 5 |

| Mean adjusted net income volatility (3) is > 0.5 and ≤ 1.25 | 3 |

| Mean adjusted net income volatility (3) is > 1.25 | 0 |

| Mean adjusted net income volatility (3) is negative or the mean net income or loss (3.2) is “zero” | 0 |

| 3.13 Mean adjusted net income volatility score |

4. STRESS-TESTED NET INCOME

If a member institution has reported “N/A” (“not applicable”) in element 3.13, it must report “N/A” for elements 4A, 4B and 4.3.

Formulas:

(Net income or loss) – (1 × Standard deviation of the net income or loss) = Stress-tested net income using one standard deviation

(Net income or loss) – (2 × Standard deviation of the net income or loss) = Stress-tested net income using two standard deviations

Complete the following:

Stress-tested net income using one standard deviation:

4.1_________ – (1 × 4.2 _________) = 4A __________

Stress-tested net income using two standard deviations:

4.1_________ – (2 × 4.2 _________) = 4B __________

Elements

Use the instructions below to arrive at the elements of the formulas.

4.1 Net Income or Loss

Net income or loss as determined for element 2.1.

4.2 Standard deviation of the Net Income or Loss

The standard deviation of the net income or loss as determined for element 3.1.

Score

Use the scoring grid below to determine the member institution’s score.

| Range of results | Score |

|---|---|

| Stress-tested net income using two standard deviations (4B) is ≥ 0 | 5 |

| Stress-tested net income using one standard deviation (4A) is ≥ 0, but stress-tested net income using two standard deviations (4B) is < 0 | 3 |

| Stress-tested net income using one standard deviation (4A) is < 0 | 0 |

| 4.3 Stress-tested net income score |

18. The portion of item 5 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law beginning with the heading “Elements” and ending before the heading “Score” is replaced by the following:

Elements

Use the instructions below to arrive at the elements of the formula.

Refer to the Consolidated Statement of Comprehensive Income, Retained Earnings and AOCI, Reporting Manual, completed in accordance with that Manual for the fiscal year ending in the year preceding the filing year.

5.1 Total Non-Interest Expenses

Indicate the total non-interest expenses, as set out in the Consolidated Statement of Comprehensive Income, Retained Earnings and AOCI, less any charges for impairment included in that total.

5.2 Net Interest Income

Determine the net interest income by adding (a) and (b):

- (a) Net interest income as set out in the Consolidated Statement of Comprehensive Income, Retained Earnings and AOCI

- (b) Taxable equivalent adjustment (if any)

Total (insert as element 5.2 of the formula)

5.3 Non-Interest Income

Determine the non-interest income by adding (a) and (b):

- (a) Non-interest income as set out in the Consolidated Statement of Comprehensive Income, Retained Earnings and AOCI

- (b) Taxable equivalent adjustment (if any)

Total (insert as element 5.3 of the formula)

19. (1) The heading of item 6 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law is replaced by the following:

6. NET IMPAIRED ASSETS TO TOTAL CAPITAL (%)

(2) The numerator of the formula under the heading “Formula:” in item 6 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law is replaced by “Net impaired on- balance sheet assets + Net impaired off-balance sheet assets”.

(3) The portion of item 6 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law beginning with the heading “Complete the following:” and ending before Table 6A is replaced by the following:

Complete the following:

![]()

Elements

Use the instructions below to arrive at the elements of the formula. Refer to the following documents:

- (a) the Return of Impaired Assets, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year; and

- (b) the Basel III Capital Reporting — Credit, Market and Operational Risk (BCAR) form, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year.

6.1 Net Impaired On-Balance Sheet Assets

Indicate the net impaired on-balance sheet assets as set out for the total of the column “Net Impaired Amount” in the Return of Impaired Assets. If the result is negative, report “zero”.

6.2 Net Impaired Off-Balance Sheet Assets

Calculate the net impaired off-balance sheet assets by subtracting the total of the column “Individual allowance for impairment” in Table 6A from the total of the column “Credit equivalent” in that Table. If the result is negative, report “zero”.

6.3 Total Capital

Indicate the total capital set out in Schedule 1 of the BCAR form.

(4) The portion of Table 6A of item 6 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law under the heading “Table 6A — Impaired Off-balance Sheet Assets” beginning with “(Complete Table 6A” and ending with “Capital Adequacy Requirements (CAR) 2013 Guideline of the Guidelines.)” is replaced by the following:

(Complete Table 6A as of the end of the fiscal year ending in the year preceding the filing year, referring to Schedule 39 - Off- balance Sheet Exposures Excluding Derivatives and Securitization Exposures and Schedule 40 - Derivative Contracts of the BCAR form and to the Capital Adequacy Requirements Guideline of the Guidelines.)

(5) The second note after Table 6A of item 6 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law is replaced by the following:

** Refer to the Capital Adequacy Requirements Guideline to determine the applicable credit conversion factor.

(6) The portion of Table 6B of item 6 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law under the heading “Table 6B — Impaired OTC Derivative Contracts” beginning with “(Complete Table 6B” and ending with “Capital Adequacy Requirements (CAR) 2013 Guideline of the Guidelines.)” is replaced by the following:

(Complete Table 6B as of the end of the fiscal year ending in the year preceding the filing year, referring to Schedule 39 - Off- balance Sheet Exposures Excluding Derivatives and Securitization Exposures and Schedule 40 - Derivative Contracts of the BCAR form and to the Capital Adequacy Requirements Guideline of the Guidelines.)

(7) The portion of item 6 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law beginning with the heading “Score” and ending before item 7 is replaced by the following:

Score

Use the scoring grid below to determine the member institution’s score.

| Range of results | Score |

|---|---|

| Net impaired assets to total capital (6) is < 20% | 5 |

| Net impaired assets to total capital (6) is ≥ 20% and < 40% | 3 |

| Net impaired assets to total capital (6) is ≥ 40% | 0 |

| 6.4 Net impaired assets to total capital score |

20. (1) The four paragraphs after the heading “7. THREE- YEAR MOVING AVERAGE ASSET GROWTH (%)” in item 7 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law are replaced by the following:

If a member institution has been operating as a member institution for less than six fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for element 7 but still fill in any of elements 7.1 to 7.4 that apply to it.

If a member institution formed by an amalgamation involving only one member institution has been operating as a member institution for less than four fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), in addition to filling in the applicable elements as an amalgamated member institution, it must also fill in the applicable elements for the amalgamating member institution.

If a member institution formed by an amalgamation involving two or more member institutions has been operating as a member institution for less than four fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for elements 7 and 7.5 but still fill in any of elements 7.1 to 7.4 that apply to it.

If a member institution acquires assets in the fiscal year ending in the year preceding the filing year as a result of a merger with or the acquisition of a regulated deposit-taking institution or as a result of the acquisition of the deposit-taking business of a regulated institution, and the value of those acquired assets on the date of their acquisition exceeds 15% of the value of the consolidated assets of the member institution immediately before that merger or acquisition, the member institution must include the value of those acquired assets in elements 7.1 to 7.3.

(2) The portion of item 7 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law beginning with the heading “Elements” and ending before the heading “Assets for Years 1 to 4” is replaced by the following:

Elements

Use the instructions below to arrive at the elements of the formula.

Refer to Section I of the Consolidated Monthly Balance Sheet, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year indicated under the heading "Assets for Years 1 to 4" below and to the Basel III Capital Adequacy Reporting — Credit, Market and Operational Risk (BCAR) form, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year indicated under the heading "Assets for Years 1 to 4" below.

(3) The portion of item 7 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law under the heading “Assets for Years 1 to 4” beginning with “For fiscal years ending in 2010, the total of” and ending before “Year 1:” is replaced by the following:

The total of

- (a) the amount of net on- and off-balance sheet assets set out in Schedule 1 of the BCAR form plus the transitional adjustment, if any, for grandfathered treatment of certain assets not derecognized under IFRS set out in Schedule 45 of the BCAR form;

- (b) the total of the amounts set out in the column "Total" for Securitized Assets – Unrecognized – Institution’s own assets (bank originated or purchased) – Traditional securitizations of Section I – Memo Items of the Consolidated Monthly Balance Sheet; and

- (c) if applicable, the value of assets, acquired by the member institution in the fiscal year ending in the year preceding the filing year as a result of a merger or acquisition referred to in the fourth paragraph under the heading "7. THREE-YEAR MOVING AVERAGE ASSET GROWTH (%)", for years 1, 2 and 3 below, if the value of those assets on the date of their acquisition exceeds 15% of the value of the consolidated assets of the member institution immediately before that merger or acquisition.

(4) The portion of item 7 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law beginning with the heading “Score” and ending before item 8 is replaced by the following:

Score

Use the scoring grid below to determine the member institution’s score.

| Range of results | Score |

|---|---|

| Three-year moving average asset growth is ≤ 15% (including negative results) | 5 |

| Three-year moving average asset growth is > 15% and ≤ 40% | 3 |

| Three-year moving average asset growth is > 40% | 0 |

| 7.5 Three-year moving average asset growth score |

21. (1) The portion of item 8 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law under the heading “8. REAL ESTATE ASSET CONCENTRATION” is amended by adding the following before the heading “Threshold Formula:”:

A member institution that is a domestic systemically important bank is not required to complete item 8 and will insert “N/A” as its score for element 8.5. It must complete element 8-1.

(2) The portion of item 8 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law beginning with the heading “Elements” and ending before the heading “Score” is replaced by the following:

Elements

Use the instructions below to arrive at the elements of the threshold formula.

Refer to Section I of the Consolidated Monthly Balance Sheet, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year.

8.1 Total Mortgage Loans

The total mortgage loans is the total of the amounts set out in the column "Total" describing Mortgages, less allowance for impairment of Section I — Assets of the Consolidated Monthly Balance Sheet, before deducting any allowance for impairment.

8.2 Total Non-Mortgage Loans

The total non-mortgage loans is the total of the amounts set out in the column "Total" describing Non-Mortgage Loans, less allowance for impairment of Section I — Assets of the Consolidated Monthly Balance Sheet.

8.3 Total Securities

The total securities is the total of the amounts set out in the column "Total" for Securities set out in Section I — Assets of the Consolidated Monthly Balance Sheet.

8.4 Total Acceptances

The total acceptances is the total of the amounts set out in the column "Total" for Customers liability under acceptances, less allowance for impairment set out in Section I — Assets of the Consolidated Monthly Balance Sheet.

If the result of the threshold formula is less than 10%, score five for element 8.5 and do not complete the rest of section 8.

If that result is greater than or equal to 10%, complete the rest of section 8.

Fill in Table 8 using the definitions and instructions below.

Refer to Section III of the Mortgage Loans Report, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year. A member institution may complete these calculations using the information reported in the Mortgage Loans Report filed at its year-end or, if not filed at its year-end, at the calendar quarter-end preceding that year-end.

Fill in Table 8 for each of the following types of mortgages.

Residential Properties Mortgage Loans

Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual.

Calculate the total mortgage loans of this type by adding together the amounts set out for "Total Residential" in the columns "Insured Gross Mortgage Loans Outstanding" and "Uninsured Gross Mortgage Loans Outstanding", respectively, in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment.

Land Development Mortgage Loans

Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual.

Calculate by adding together

- (a) the total land banking and development mortgage loans determined by adding together the amounts set out for Land Banking and Development in the columns "Insured Gross Mortgage Loans Outstanding" and "Uninsured Gross Mortgage Loans Outstanding", described in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment, and

- (b) the total residential interim construction mortgage loans determined by adding together the amounts set out for "Of Which Residential Interim Construction Mortgages" in the columns "Insured Gross Mortgage Loans Outstanding" and "Uninsured Gross Mortgage Loans Outstanding", described in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment.

Hotel and Motel Properties Mortgage Loans

Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual.

Calculate the total mortgage loans of this type by adding together the amounts set out for Hotels/Motels in the columns "Insured Gross Mortgage Loans Outstanding" and "Uninsured Gross Mortgage Loans Outstanding", respectively, in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment.

Industrial Properties Mortgage Loans

Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual.

Calculate the total mortgage loans of this type by adding together the amounts set out for Industrial Buildings in the columns "Insured Gross Mortgage Loans Outstanding" and "Uninsured Gross Mortgage Loans Outstanding", respectively, in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment.

Single Family Dwelling Properties Mortgage Loans

Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual.

Calculate the total mortgage loans of this type by adding together the amounts set out for Single Detached and Condominiums in the columns "Insured Gross Mortgage Loans Outstanding" and "Uninsured Gross Mortgage Loans Outstanding", respectively, in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment.

Second or Subsequent Mortgage Loans

Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual.

The total mortgage loans of this type is the amount set out for Second and Subsequent Mortgages in the column "Amounts Outstanding" in the second table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment.

Real Estate Under Power of Sale or Foreclosed Properties

Properties of this type, located in Canada, are to be classified in accordance with the Reporting Manual.

Calculate by adding together

- (a) for foreclosed properties located in Canada, the amount set out in the column "Total" for Foreclosed long-lived assets acquired in the liquidation of a loan — Held for sale of Section I — Memo Items of the Consolidated Monthly Balance Sheet, and

- (b) for real estate under power of sale, the amount set out in the column "Total" for Power of Sale Loans related to Real Estate of Section I — Memo Items of the Consolidated Monthly Balance Sheet.

Table 8

| A | B | C | D | E |

|---|---|---|---|---|

| Type | Amount | Percentage of Total Mortgage Loans (Amount from Column B ÷ Total Mortgage Loans (see reference 1*)) x 100 |

Range of Results | Score (see reference 2*) |

| Residential Properties Mortgage Loans | < 50% = 0 ≥ 50% and < 75% = 3 ≥ 75% = 5 | |||

| Land Development Mortgage Loans | > 10% = 0 > 5% and ≤ 10% = 3 ≤ 5% = 5 | |||

| Hotel and Motel Properties Mortgage Loans | > 10% = 0 > 5% and ≤ 10% = 3 ≤ 5% = 5 | |||

| Industrial Properties Mortgage Loans | > 15% = 0 > 10% and ≤ 15% = 3 ≤ 10% = 5 | |||

| Single Family Dwelling Properties Mortgage Loans | < 35% = 0 ≥ 35% and < 50% = 3 ≥ 50% = 5 | |||

| Second or Subsequent Mortgage Loans | > 10% = 0 > 5% and ≤ 10% = 3 ≤ 5% = 5 | |||

| Real Estate Under Power of Sale or Foreclosed Properties | > 8% = 0 > 5% and ≤ 8% = 3 ≤ 5% = 5 |

- Reference 1*

"Total Mortgage Loans" used in the calculation in column C must correspond to the amount of the Total Mortgage Loans determined for element 8.1. - Reference 2*

Fill in the score in column E for a type of mortgage loan or property set out in column A that corresponds to the percentage set out in column C, in accordance with the appropriate range set out in column D.

22. The Reporting Form set out in Part 2 of Schedule 2 to the By-law is amended by adding the following after item 8:

8-1. ASSET ENCUMBRANCE MEASURE

Only a member institution that is a domestic systemically important bank must complete item 8-1. All other member institutions are to insert "N/A" for item 8-1.3.

8-1.1 Unencumbered Asset Concentration

Threshold Formula:

![]()

Complete the following:

![]()

Elements

Use the instructions below to arrive at the elements of the formula.

Refer to the Consolidated Monthly Balance Sheet and Section I of the Pledging and Repos Report, Reporting Manual, all completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year.

8-1.1.1 Total Liabilities

The total liabilities is calculated by deducting from the amount set out in the column "Total" for Total Liabilities and Shareholders’ Equity the amounts included as shareholders’ equity in Section II – Liabilities of the Consolidated Monthly Balance Sheet.

8-1.1.2 Subordinated Debt

The total subordinated debt is the amount set out in the column "Total" for Subordinated Debt in Section II – Liabilities of the Consolidated Monthly Balance Sheet.

8-1.1.3 Covered Bonds Liabilities

The covered bonds liabilities is the total of the amounts set out in the column "Total" for Selected information on covered bonds liabilities in Section II – Memo Items of the Consolidated Monthly Balance Sheet.

8-1.1.4 Securitization Liabilities

The securitization liabilities is the total of the amounts set out in the column "Total" for Securitization notes payable (institution’s own assets) and Securitization notes payable (third party assets) as set out for the Mortgages and Loans Payable in Section II – Memo Items of the Consolidated Monthly Balance Sheet.

8-1.1.5 Repos

The obligations related to assets sold under repurchase agreements is the amount set out in the column "Total" for Obligations related to assets sold under repurchase agreements in Section II – Liabilities of the Consolidated Monthly Balance Sheet.

8-1.1.6 Shorts

The obligations related to borrowed securities is the amount set out in the column "Total" for Obligations related to borrowed securities in Section II – Liabilities of the Consolidated Monthly Balance Sheet.

8-1.1.7 Total Assets

The total assets is the amount set out in the column "Total" for Total assets in Section I – Assets of the Consolidated Monthly Balance Sheet.

8-1.1.8 Impairment

Impairment is the total amount set out in the column "Gross Impaired Assets" under Impaired Assets and Allowances in Section I – Memo Items of the Consolidated Monthly Balance Sheet.

8-1.1.9 Total Pledged Assets

The total pledged assets is the total of the amounts set out in the column "OUTSTANDING END OF PERIOD – CONSOLIDATED ENTITY" for TOTAL and REPURCHASE AGREEMENTS (REPOS) of SECTION I – PLEDGING AND REPURCHASE AGREEMENTS of the Pledging and Repos Report.

If the result of the threshold formula is equal to or less than 100%, score five for element 8-1.3 and do not complete the rest of item 8-1.

If the result is greater than 100%, complete the rest of item 8-1.

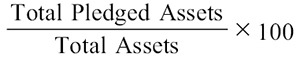

8-1.2 Pledged Asset Ratio

Formula:

Complete the following:

![]()

8-1.2.1 Total Pledged Assets

Indicate the total pledged assets as determined for element 8-1.1.9.

8-1.2.2 Total Assets

Indicate the total assets as determined for element 8-1.1.7.

Score

Use the scoring grid below to determine the member institution’s score.

| Range of results | Score |

|---|---|

| Result of the threshold formula in 8-1.1 is ≤100% | 5 |

| Result of the formula in 8-1.2 is < 50% | 3 |

| Result of the formula in 8-1.2 is ≥ 50% | 0 |

| 8-1.3 Asset Encumbrance Measure Score |

23. (1) The second paragraph after the heading “9. AGGREGATE COMMERCIAL LOAN CONCENTRATION RATIO (%)” in item 9 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law is replaced by the following:

If the result of the threshold formula in section 8 is equal to or less than 90%, or the member institution is a domestic systemically important bank, complete section 9.

(2) The portion of item 9 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law beginning with the heading “Elements” and ending before element 9.1 is replaced by the following:

Elements

Refer to the Non-Mortgage Loans Report, Reporting Manual, completed in accordance with that Manual. Use the instructions below to arrive at the elements of the formula. A member institution may complete these calculations using the information reported in the Non-Mortgage Loans Report filed at its year-end or, if not filed at its year-end, at the calendar quarter-end preceding that year-end.

(3) The paragraph after the heading “9.2 Total Capital” in item 9 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law is replaced by the following:

The total capital as determined for element 6.3, expressed in thousands of dollars.

(4) The portion of item 9 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law beginning with the heading “Industry Sector List” and ending before Table 9 is replaced by the following:

Industry Sector List

Calculate the commercial loans for each of the industry sectors in accordance with the following list and insert each of the totals on the appropriate line in Column A in Table 9. Refer to the Non-Mortgage Loans Report, Reporting Manual, completed in accordance with that Manual.

Agriculture

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Agriculture in the Non-Mortgage Loans Report.

Fishing and Trapping

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Fishing and Trapping in the Non-Mortgage Loans Report.

Logging and Forestry

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Logging and Forestry in the Non-Mortgage Loans Report.

Mining, Quarrying and Oil Wells

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Mining, Quarrying and Oil Wells in the Non-Mortgage Loans Report.

Manufacturing

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Manufacturing in the Non-Mortgage Loans Report.

Construction/Real Estate

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Construction/Real Estate in the Non-Mortgage Loans Report.

Transportation, Communication and Other Utilities

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Transportation, Communication and Other Utilities in the Non-Mortgage Loans Report.

Wholesale Trade

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Wholesale Trade in the Non-Mortgage Loans Report.

Retail

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Retail in the Non-Mortgage Loans Report.

Service

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Service in the Non-Mortgage Loans Report.

Multiproduct Conglomerates

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Multiproduct Conglomerates in the Non-Mortgage Loans Report.

Others (Private Not for Profit Institutions, Religious, Health and Educational Institutions)

Commercial loans of this type are to be classified in accordance with the Reporting Manual.

Calculate the total by adding together the amounts in the columns "Resident Loan Balances, TC" and "Non-Resident Loan Balances, TC" and subtracting the amount in the column "Allowance for Impairment, TC", all as set out for Others (Private Not for Profit Institutions, Religious, Health and Educational Institutions) in the Non-Mortgage Loans Report.

(5) The first instruction after the heading “Instructions” in Table 9 of item 9 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law is replaced by the following:

Insert 10% of total capital as determined for element 6.3: 9.3_______

(6) The portion of item 9 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law beginning with the heading “Score” and ending before item 10 is replaced by the following:

Score

Use the scoring grid below to determine the member institution’s score.

| Range of results | Score |

|---|---|

| Result of the threshold formula in section 8 is > 90% | 5 |

| Aggregate commercial loan Concentration Ratio (9) < 100% | 5 |

| Aggregate commercial loan Concentration Ratio (9) ≥ 100% and < 300% | 3 |

| Aggregate commercial loan Concentration Ratio (9) ≥ 300% | 0 |

| 9.4 Aggregate commercial loan concentration ratio score |

24. The portion of item 10 of the Reporting Form set out in Part 2 of Schedule 2 to the By-law before “The information provided in this Reporting Form is based on:” is replaced by the following:

10. TOTAL QUANTITATIVE SCORE

Using the scores from each of the preceding items, fill in the scoring grid below to determine the total quantitative score.

| Factor | Element | Score |

|---|---|---|

| Capital Adequacy | 1.5 | |

| Return on Risk-Weighted Assets | 2.4 | |

| Mean Adjusted Net Income Volatility | 3.13 | |

| Stress-Tested Net Income | 4.3 | |

| Efficiency Ratio | 5.4 | |

| Net Impaired Assets to Total Capital | 6.4 | |

| Three-Year Moving Average Asset Growth | 7.5 | |

| Real Estate Asset Concentration (see reference 3*) | 8.5 | |

| Asset Encumbrance Measure (see reference 4*) | 8-1.3 | |

| Aggregate Commercial Loan Concentration Ratio | 9.4 | |

| Subtotal | ||

If elements 3.13, 4.3 and 7.5 are all "N/A", fill in the result determined in accordance with the following formula: (Subtotal ⁄ 45) × 15 If none of elements 3.13, 4.3 and 7.5 are "N/A", fill in "zero". If only element 7.5 is "N/A", fill in the result determined in accordance with the following formula: (Subtotal ⁄ 55) × 5 |

||

| Total Quantitative Score |

- Reference 3*

Every member institution that is not a domestic systemically important bank must complete this item. - Reference 4*

Only a member institution that is a domestic systemically important bank must complete this item.

25. Schedule 3 to the By-law is replaced by the Schedule 3 set out in Schedule 2 to this By-law.

26. The French version of the By-law is amended by replacing “vérifiés” with “audités” in the following provisions:

- (a) the portion of subsection 1(4) before paragraph (a);

- (b) paragraph 15(2)(a), the portion of subsection 15(4) before paragraph (a) and the portion of paragraph 15(4)(b) before subparagraph (i);

- (c) subparagraph 16(1)(b)(i) and the portion of subsection 16(2) before subparagraph (b)(i); and

- (d) the portion of item 10 of Part 2 of Schedule 2 beginning with “Les renseignements inscrits sur ce formulaire sont fondés sur (cocher selon ce qui est applicable) :” and ending before the heading “Déclaration”.

COMING INTO FORCE

27. This By-law comes into force on the day on which it is registered.

SCHEDULE 1

(Section 13)

SCHEDULE 1

(Sections 3, 4, 7, 8 and 12)

PREMIUM CATEGORIES

| Item | Column 1 | Column 2 | Column 3 | |||

|---|---|---|---|---|---|---|

| Premium Category | Total Score | Percentage | ||||

| Premium Year Beginning in 2015 | Premium Year Beginning in 2016 | Premium Year Beginning in 2017 | Premium Years Beginning in or After 2018 | |||

| 1. | 1 | ≥ 80 | 13.5% | 16.5% | 19.5% | 22.5% |

| 2. | 2 | ≥ 65 and < 80 | 27% | 33% | 39% | 45% |

| 3. | 3 | ≥ 50 and < 65 | 54% | 66% | 78% | 90% |

| 4. | 4 | < 50 | 100% | 100% | 100% | 100% |

SCHEDULE 2

(Section 25)

SCHEDULE 3

(Subsection 1(5) and sections 21 to 24.1 and 26)

SCORING GRID — QUANTITATIVE ASSESSMENT

PART 1

CAPITAL ADEQUACY

| Range of Results | ||||

|---|---|---|---|---|

| Item | Column 1 Leverage Ratio |

Column 2 Score |

Column 3 Tier 1 Capital Ratio |

Column 4 Score |

| 1. | Assets to capital multiple is ≤ 23 and ≤ 90% of the multiple authorized by the regulator | 10 | Tier 1 capital ratio is > the "all in" capital target Tier 1 capital ratio set by the regulator for the member institution | 10 |

| 2. | Assets to capital multiple is ≤ 23 and ≤ 100% of the multiple authorized by the regulator | 7 | Tier 1 capital ratio is ≤ the "all in" capital target Tier 1 capital ratio set by the regulator for the member institution but > the minimum Tier 1 capital ratio required by the regulator | 6 |

| 3. | Assets to capital multiple is > 23 or > 100% of the multiple authorized by the regulator | 0 | Tier 1 capital ratio is < the minimum Tier 1 capital ratio required by the regulator | 0 |

| Total of Leverage Ratio Score plus Tier 1 Capital Ratio Score | ||||

PART 2

OTHER QUANTITATIVE FACTORS OR CRITERIA

| Item | Column 1 Factors or Criteria |

Column 2 Range of Results |

Column 3 Score |

|---|---|---|---|

| 4. | Return on Risk-Weighted Assets | ≥ 1.15% | 5 |

| ≥ 0.75% and < 1.15% | 3 | ||

| < 0.75% (including negative results) | 0 | ||

| 5. | Mean Adjusted Net Income Volatility | ≥ 0 and ≤ 0.5 | 5 |

| > 0.5 and ≤ 1.25 | 3 | ||

| > 1.25 | 0 | ||

| if the result is negative or the mean net income or loss is zero | 0 | ||

| 6. | Stress-Tested Net Income | ||

| (a) using two standard deviations | ≥ 0 | 5 | |

| (b) using one and two standard deviations | ≥ 0 and < 0 respectively | 3 | |

| (c) using one standard deviation | < 0 | 0 | |

| 7. | Efficiency Ratio | ≤ 65% | 5 |

| > 65% and ≤ 85% | 3 | ||

| > 85% or a negative number | 0 | ||

| 8. | Net Impaired Assets to Total Capital | < 20% | 5 |

| ≥ 20% and < 40% | 3 | ||

| ≥ 40% | 0 | ||

| 9. | Three-Year Moving Average Asset Growth | ≤ 15% (including negative results) | 5 |

| > 15% and ≤ 40% | 3 | ||

| > 40% | 0 | ||

| 10. | Aggregate Commercial Loan Concentration Ratio | < 100% | 5 |

| ≥ 100% and < 300% | 3 | ||

| ≥ 300% | 0 | ||

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the By-law.)

Description

The Board of Directors of the Canada Deposit Insurance Corporation (CDIC) made the Differential Premiums By-law (By-law) on March 3, 1999, pursuant to subsection 21(2) and paragraph 11(2)(g) of the Canada Deposit Insurance Corporation Act (CDIC Act). Subsection 21(2) of the CDIC Act authorizes the CDIC Board of Directors to make by-laws establishing a system of classifying member institutions into different categories, setting out the criteria or factors the CDIC will consider in classifying members into categories, establishing the procedures the CDIC will follow in classifying members, and fixing the amount of, or providing a manner of determining the amount of, the annual premium applicable to each category. The CDIC Board of Directors amended the By-law on January 12 and December 6, 2000, July 26, 2001, March 7, 2002, March 3, 2004, February 9 and April 15, 2005, February 8 and December 6, 2006, December 3, 2008, December 2, 2009, December 8, 2010, December 7, 2011, December 5, 2012, and December 4, 2013.

In addition to an annual review of this By-law to confirm that it is technically up to date, the CDIC has undertaken a comprehensive review of the By-law to ensure that the differential premiums system in its entirety is up to date, is relevant and supports the achievement of CDIC’s objects. As a result of the review, both substantive changes as well as technical amendments need to be made.

A number of the substantive changes are necessary to capture changes in the regulatory environment, such as the introduction of new capital adequacy guidelines and the designation of some member institutions as domestic systemically important banks (DSIBs) to which a new measure — Asset Encumbrance — will be applied.

A further substantive change is being made to the percentage of the maximum premium rate to be paid by member institutions assigned to the various categories. The change ensures that premium rate increases announced by the CDIC in its corporate plan do not breach the maximum premium rate chargeable under the CDIC Act.

Many of the technical amendments are being made to limit the necessity of future annual technical amendments to the By-law. In particular, the exact location by line reference to a data source is being changed to a textual description of the data source. In future, when the location of the line changes without any change to the data or its description, an amendment to the By-law will no longer be necessary.

Both the technical and substantive changes are reflected in the By-law Amending the Canada Deposit Insurance Corporation Differential Premiums By-law (Amending By-law). The following table provides more detail about the amendments:

| AMENDING BY-LAW SECTION | BY-LAW SECTION | EXPLANATION |

|---|---|---|

| By-law | ||

| 1 | 1 | Technical Introduces two new definitions. The first defines "domestic systemically important bank" and the second introduces "guidelines for member institutions" as a way to more easily refer to "Guidelines for Banks or Guidelines for Trust and Loan Companies." |

| 2 and 3 | 3(b) and 4(1) | Technical As a result of amendments to Schedule 1 to the By-law, it is necessary to introduce a reference to the applicable premium year in each of the formulae. |

| 4, 5, 7 and 8 | Technical Paragraph 15(1)(d) has been repealed. As a result, all references to "paragraphs 15(1)(c) to (e)" are being replaced by references to "paragraphs 15(1)(c) and (e)." These references occur in 6(1)(a), 6(1)(b), 12(1), 15(1)(c), 15(1)(f), 15(2), 15(4)(a), 15(4)(b), 16(1) and 16(2). |

|

| 6 | 14(3) | Technical Subsection 14(3) is repealed. It related to an adjusted formula (since repealed) that was only in effect for the 2012 premium year. |

| 7(1) | 15(1)(c) and (d) | Technical The new paragraph 15(1)(c) combines the current paragraphs 15(1)(c) and (d) into one paragraph confirming that the same capital adequacy reporting documentation must be filed by all members, whether provincial or federal. This is the section that repeals paragraph 15(1)(d). |

| 7(2) | 15(1)(e)(i) to (vi) | Technical References to "tabs" in the Reporting Manual are removed, as the Reporting Manual no longer contains tabs. Substantive Introduces the requirement to submit the Pledging and REPOS report. |

| 7(5) | 15(3) | Technical Updates financial statement reporting standards from GAAP to International Financial Reporting Standards (IFRS). |

| 9 | 17 | Technical Since the certification to which this section refers has been repealed, this section no longer refers to it. |

| 10 | 21 | Substantive This section refers to the revised assignment of a score with respect to the Capital Adequacy factor, which has been significantly changed — see section 15 of the Amending By-law below. |

| 11 | 25 | Substantive This amendment confirms that the factor titled Real Estate Asset Concentration applies to all members except domestic systemically important banks. |

| 12 | New 25.1 | Substantive This amendment introduces a factor titled Asset Encumbrance, which applies only to domestic systemically important banks. |

| Schedule 1, Premium Categories | ||

| 13 | Schedule 1 | Substantive In its corporate plan, the CDIC proposes increases to the premium rates of approximately 1 basis point per year over a five-year period charged to the member institutions classified in the best-rated category. In order to introduce these increases, changes needed to be made to the percentage of the maximum premium rate to be paid for each premium year by member institutions assigned to the various categories to ensure that the premium rate increases do not breach the maximum premium rate chargeable under the CDIC Act, i.e. 33 basis points. The amendment sets the percentage of the maximum rate to be charged to institutions classified in each of the four categories for each of the next four years and thereafter. [The maximum rate in effect each year is set pursuant to subsection 21(4) of the CDIC Act but cannot exceed 33 basis points.] |

| Schedule 2, Part 1, Interpretation | ||

| 14 | Technical Applies the same guidelines to federal credit unions as are applied to banks. |

|

| Schedule 2, Part 2, Reporting Form | ||

| 15 | Item 1 | Substantive The Capital Adequacy Measure is replaced with a two-prong test. The first component is a Leverage Ratio. An institution will obtain full marks for this component if its Assets to Capital Multiple (ACM) is at no more than 90% of its authorized ACM. The second prong is a Capital Ratio. An institution will obtain full marks if its Tier 1 capital ratio is greater than its "all in" capital target Tier 1 capital ratio set by the regulator (including, as applicable, any capital conservation buffer or domestic systemically important bank surcharge). |

| 16 | Item 2 | Technical The Return on Risk-Weighted Assets factor is amended by referencing Tier 1 risk-weighted assets, and references to the Reporting Manual are updated. |

| 17 | Item 3 | Substantive The Mean Adjusted Net Income Volatility factor is amended as follows. (a) Calculate the volatility over a 10-year period rather than the current 5-year period (previously, the CDIC did not have access to more than 5 years of data). For new member institutions, calculation of this factor will begin when 5 years of data is available. (b) Use standard deviation rather than semi-deviation in the calculation. The proposed statistical measure (standard deviation) will capture all variations in net income as compared to the mean, both positive and negative, rather than only the volatility associated with drops in net income, which is the case when using semi-deviation. (c) Thresholds for mark allocation have been adjusted to accommodate standard deviation. |

| 18 | Item 4 | Substantive The Stress-Tested Net Income factor is amended to reflect the change from semi-deviation to standard deviation made to the Mean Adjusted Net Income Volatility factor. |

| 19 | Item 5 | Technical The Efficiency Ratio factor is amended to remove the exact location by line reference to data sources while retaining the textual description of the data. |

| 20 | Item 6 | Substantive In the Net Impaired Assets (including Net Unrealized Losses on Securities) to Total Capital factor, all references to Net Unrealized Losses on Securities have been removed. Technical changes are also being made to update the descriptions of forms in the Reporting Manual. |

| 21 | Item 7 | Substantive The Three-Year Moving Asset Growth factor is amended as follows: (a) the threshold for relief from the impact of a large asset acquisition is increased to 15% of the value of the consolidated assets of the member immediately prior to the acquisition from the current 10%; (b) the upper scoring threshold to obtain five marks is being increased to ≤ 15% from the current ≤ 20%; and (c) technical changes are also being made to update the descriptions of forms in the Reporting Manual. |

| 22 | Item 8 | Substantive The Real Estate Asset Concentration factor is amended as follows: (a) DSIBs no longer complete this factor; (b) Home Equity Lines of Credit (HELOCs) are now to be included in the calculation of total mortgage loans; (c) the Land Banking and Development Mortgage Loans sub-criterion is being combined with the Residential Interim Construction Mortgage Loans sub-criterion to create a new sub-criterion entitled Land Development Mortgage Loans, with thresholds set at concentration levels of ≤ 5% to score five marks and those ≥ 10% score no marks; and (d) technical changes have also been made throughout to remove the exact location by line reference to data sources while retaining the textual description of the data to be used. |

| 23 | Item 8-1 | Substantive A new Asset Encumbrance factor is introduced. It applies only to DSIBs. It is a two-step measure. An institution that meets the Unencumbered Asset Concentration threshold formula will score five marks. Other institutions will score either three or zero marks depending on the extent of their Pledged Assets. |

| 24 | Item 9 | The Aggregate Commercial Loan Concentration factor is amended as follows: Substantive The scoring grid is changed. Institutions with an Aggregate Commercial Loan Concentration ratio of less than 100% will score full marks, whereas those members with a ratio greater than 300% will score no marks. Technical (a) DSIBs are directed to complete the measure; (b) descriptions of forms in the Reporting Manual are updated; and (c) the exact locations by line reference to data sources are removed while the textual description of the data to be used is retained. |

| 25 | Item 10 | Technical The Total Quantitative Score grid is amended to reflect changes made throughout the Reporting Form. |

| Schedule 3, Scoring Grid — Quantitative Assessment | ||

| 26 | Schedule 3 | Technical This schedule repeats for each of the factors the Range of Scores. It has been amended to reflect all changes to the Range of Scores for each of the factors. |

| General | ||

| 27 | Technical In French, the expression for audited financial statements has been changed throughout the By-law from "états financiers verifiés" to "états financiers audités." |

|

| 28 | The By-law comes into force on registration. |

Alternatives

There are no available alternatives. The CDIC Act specifically provides that the criteria or factors to be taken into account in determining the category in which a member institution is classified and fixing or establishing the method of determining the amount of the annual premium applicable to each category may only be made by by-law.

Benefits and costs

No additional costs should be attributed directly to these changes.

Consultation

Significant consultation with member institutions, their associations and interested parties, as well as with the public, has taken place. The first phase of consultation took place with the issuance of a consultation paper in October 2013 calling for feedback by January 2014. A further consultation paper was issued in July 2014 which outlined the results of the first round of consultation and set out proposals for change. Comments were requested by the end of August 2014. All comments were taken into account in completing the Amending By-law. The last phase of consultation took place through prepublication in Part I of the Canada Gazette on October 18, 2014, which ended on November 17, 2014.

Compliance and enforcement

There are no compliance or enforcement issues.

Contact

Sheila Salloum

Director

Insurance

Canada Deposit Insurance Corporation

50 O’Connor Street, 17th Floor

Ottawa, Ontario

K1P 6L2

Telephone: 613-947-0257

Fax: 613-996-6095

Email: ssalloum@cdic.ca

- Footnote a

S.C. 1996, c. 6, s. 27 - Footnote b

R.S., c. C-3 - Footnote c

R.S., c. 18 (3rd Supp.), s. 51 - Footnote d

S.C. 1996, c. 6, s. 27 - Footnote e

R.S., c. C-3 - Footnote 1

SOR/99-120